Strategy has launched a $ 2.1 billion share program in the market (ATM) Equity Program for its Strife (STRF) preferred shares marking another step in the company’s long-term strategy to build a Bitcoin-supported financial architecture.

The announcement was made by CEO and President Phong Lee during an investor update together with executive chairman Michael Saylor. According to Lee, strong years to date yielded results from the company’s Bitcoin-connected Securities Strike (STRK) and Strife (STRF) strategy confidence to expand its fundraising strategy.

“We are currently at 16.3% BTC yield for the year against a 25% goal,” Lee said. “BTC Dollar Gain is so far $ 7.7 billion on its way to our $ 15 billion target.”

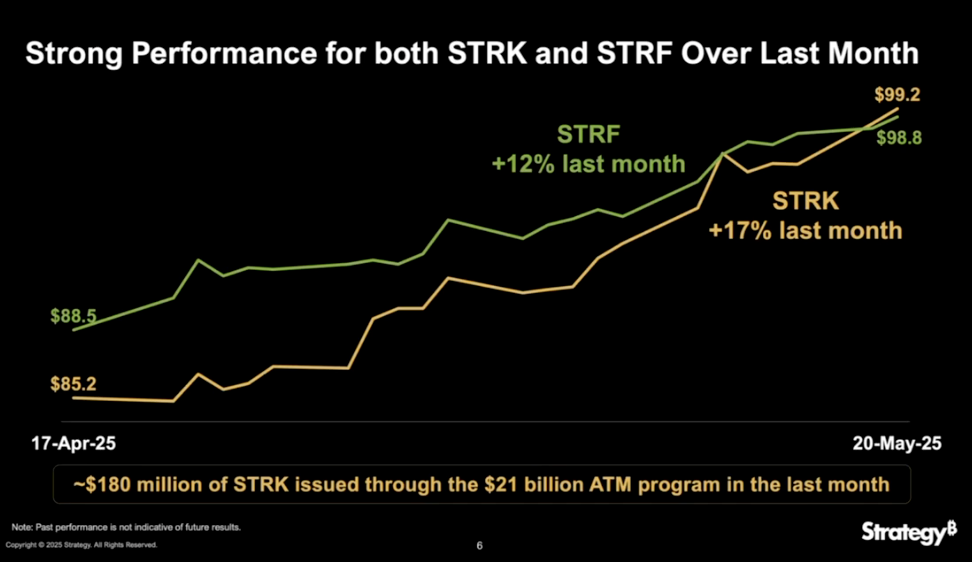

Both instruments have surpassed expectations since the launch. Strike has risen 24% from its original price of $ 80 to nearly $ 100. Strid that was priced at $ 85 just two months ago, now is about $ 98.80, an increase of 16%. In comparison, similar structured preferences in the market have fallen by 3-5% over the same period.

Over the past 30 days, the strike rose 17% and dispute 12%, which brought both close to endless value. Lee emphasized the liquidity profile of these instruments with reference to average daily trading volumes of $ 31 million for strike and $ 23 million for strife. “It’s 60x what we typically see in comparable favorite,” he noted.

The company previously issued $ 212 million through Strikes ATM without any negative price pressure. Based on the demand for trading volume and investor, Lee said the company believes that strife ATM of $ 2.1 billion can be performed in a similar way.

Strife is a perpetual preferred stock with a 10% coupon and sits at the top of the strategy’s capital stack. Saylor described it as the “crown jewel” in the company’s preferred offer. “We will be ten times as careful with strife,” he said. “Our goal is that it should be seen as a fixed income for investment quality-high quality instrument with robust protection.”

The strike, on the other hand, is located for what Saylor called “Bitcoin-nicely” investors. It carries a coupon of 8% and includes the upside through Bitcoin conversion. “Think of it as a Bitcoin scholarship with a scholarship,” Sayylor said.

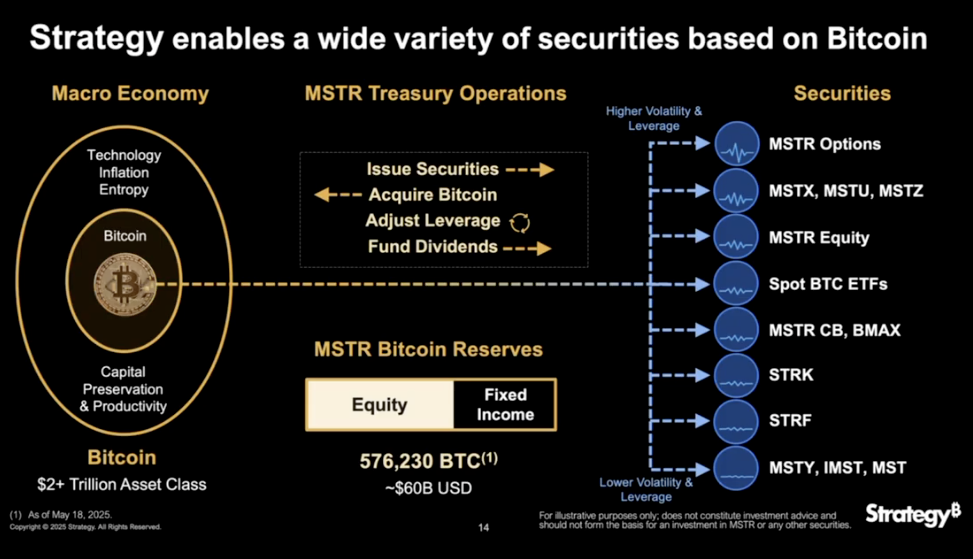

Strategy is now driving three ATM programs: $ 21 billion each for Mstr Equity and Strike and $ 2.1 billion to dispute. These are rebalanced daily with issuing issuance based on market conditions, volatility and investor demand. According to Saylor, this dynamic structure allows the company to optimize Bitcoin acquisition and capital installation across changing market environments.

Behind this strategy sits the strategy’s Bitcoin Treasury, now a total of 576,230 BTC – approx. 60 billion dollars in value. “The permanent capital is the basis of everything we build,” Sayylor said.

While Spot Bitcoin ETFs are meeting investors looking for direct price exposure, the strategy continues to offer a more nuanced set of instruments – each targeting different levels of risk, return and compliance. Strife ATM is the latest step in the wider strategy.