After an unstable start to 2025, Bitcoin has now regained the $ 100,000 mark, which sets a new highlight at all times and injects renewed confidence on the market. But as prices rise, a critical question arises: Are some of Bitcoin’s most experienced and successful holders, the long -term investors who start selling? In this piece, we analyze what Data On-Chain reveals about the behavior of the long-term owner and whether recent profits should be a cause for concern, or just a healthy part of Bitcoin’s market cycle.

Signs of profit recordings appear

The used output -profit relationship (SOPR) provides immediate insight into realized profits across the network. Zooming into recent weeks we can observe a clear uptick in surplus realization. Green bar clusters indicate that a noticeable number of investors actually sell BTC for profits, especially after the price rally from $ 74,000 to $ 75,000 to new heights over $ 100,000.

While this may be raising short -term concerns about potential overhead resistance, it is important to frame this in the wider context of the chain. This is not unusual behavior in bull markets and does not signal on your own a bicycle top.

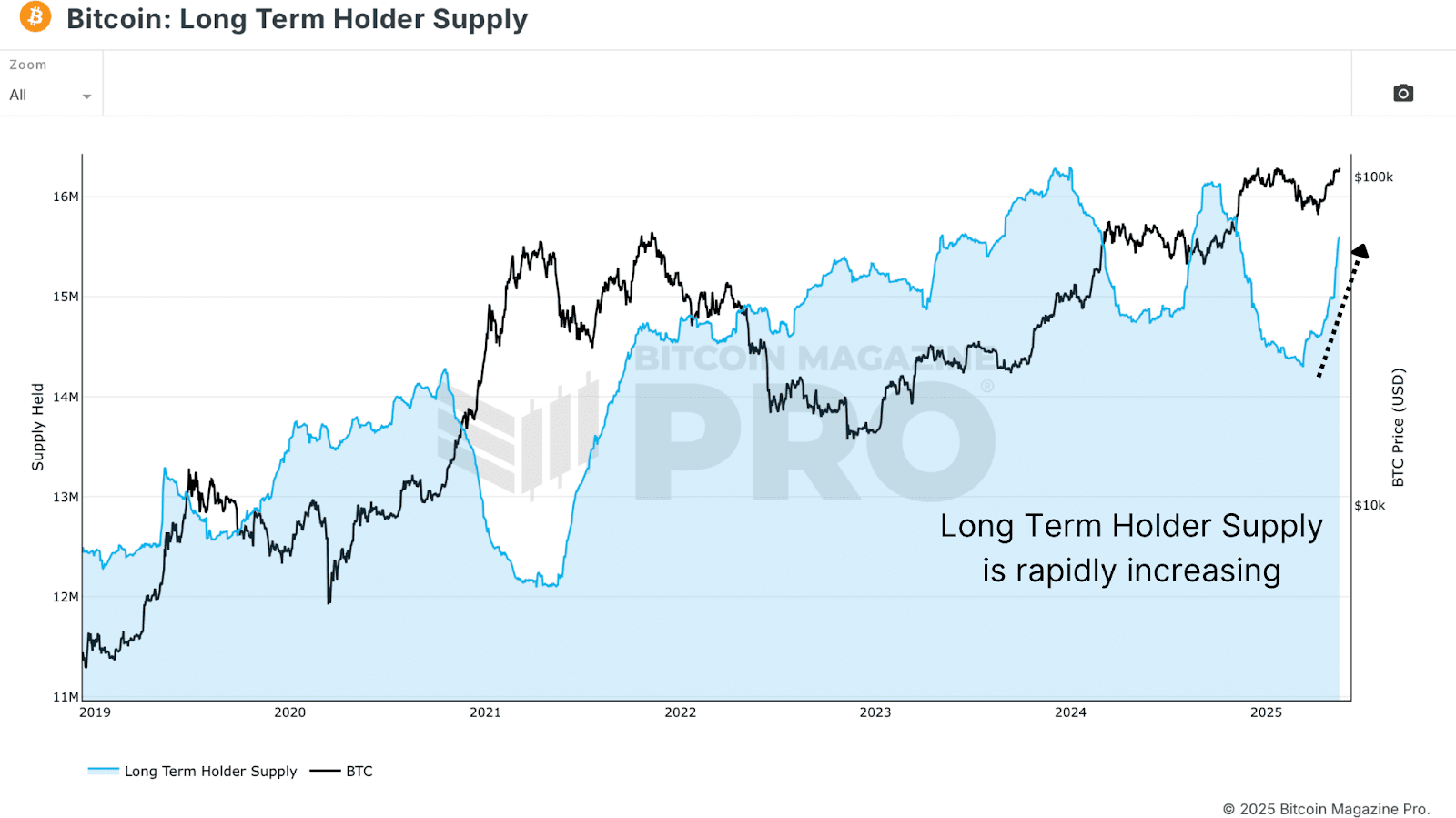

The long -term holder supply is still growing

The long -term holder supply, the total amount of bitcoin contained by addresses for at least 155 days, continues to climb even as prices rise. This metric does not necessarily mean fresh accumulation now occurs, but rather that coins become aging to long -term status without being moved or sold.

In other words, many investors who bought at the end of 2024 or early 2025 stay strong and transition to long -term holders. This is a healthy dynamic typical of the past for mid -phases in bull markets and not yet evidence of widespread distribution.

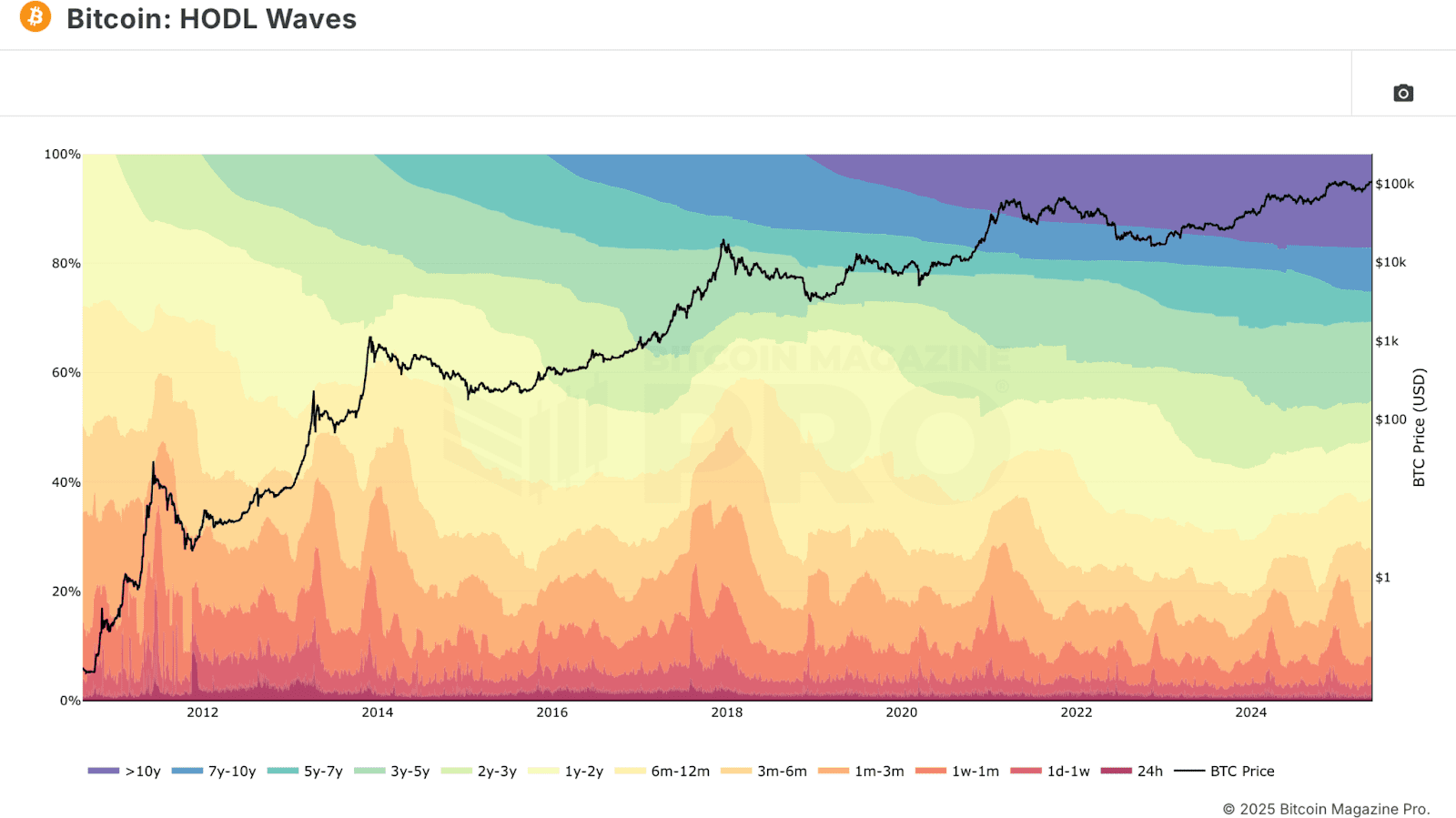

HODL waves analysis

To dig deeper, we use HODL -wave data that breaks down BTC holdings of the wallet’s age bond. When we isolate wallets that hold BTC for 6 months or more, we find that over 70% of the Bitcoin supply is currently owned by mid-time participants.

Interestingly, although this number remains high, it has begun to fall slightly, which indicates that some of the long -term owners may be selling even as the long -term proprietor supply increases. The primary driving force for the long -term proprietor supply growth seems to be short -term holders who aging in 155+ days of brackets, not fresh accumulation or large -scale purchase.

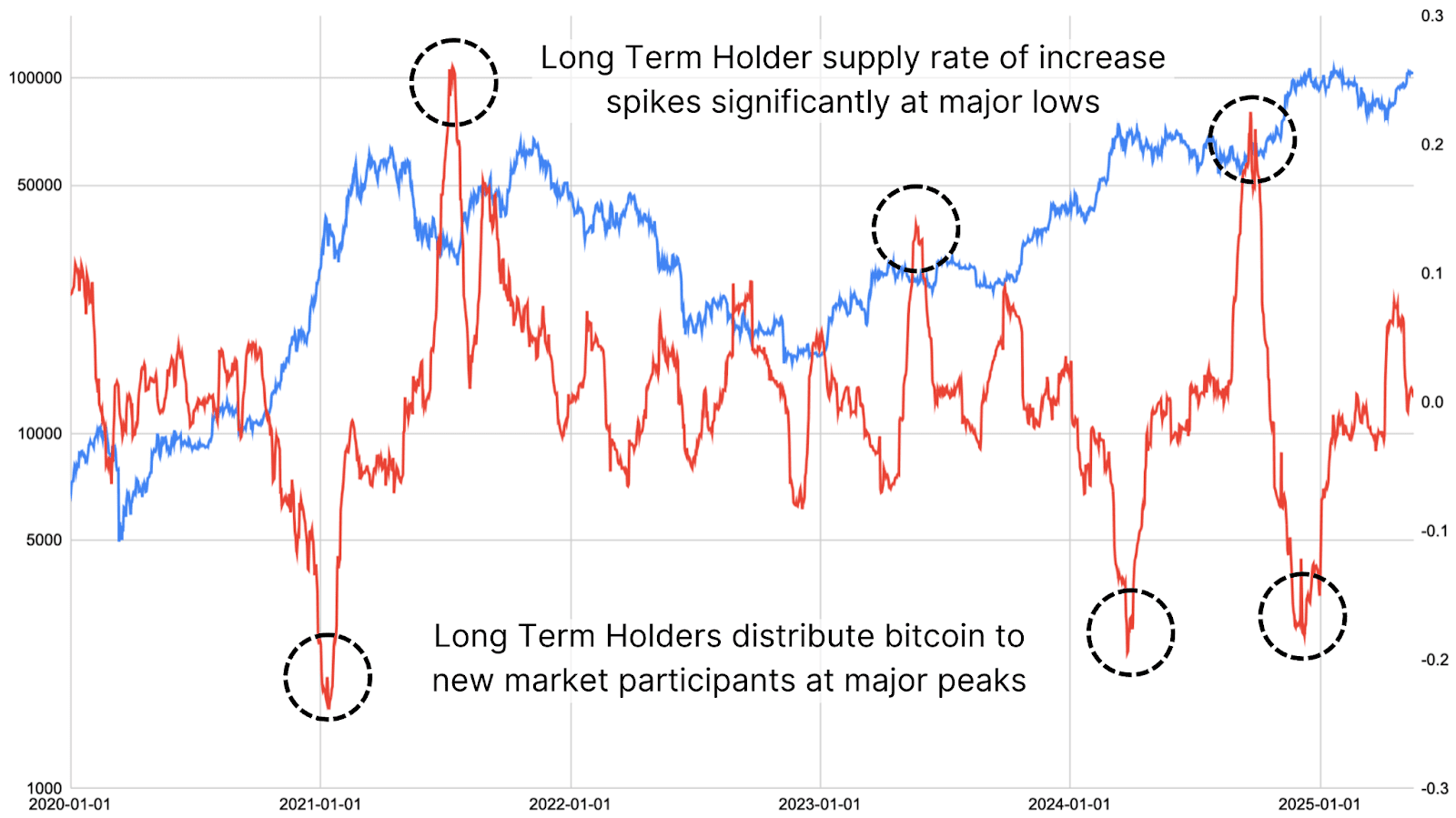

Using Raw Bitcoin Magazine Pro API data, we examined the speed of change in long-term balances, categorized by wallet. When this metric tendency downward is significantly down, it is historically coincidental with the bike peaks. Conversely, when it spides upwards, it has often marked market bottoms and periods of deep accumulation.

Short -term shifts and distribution conditions

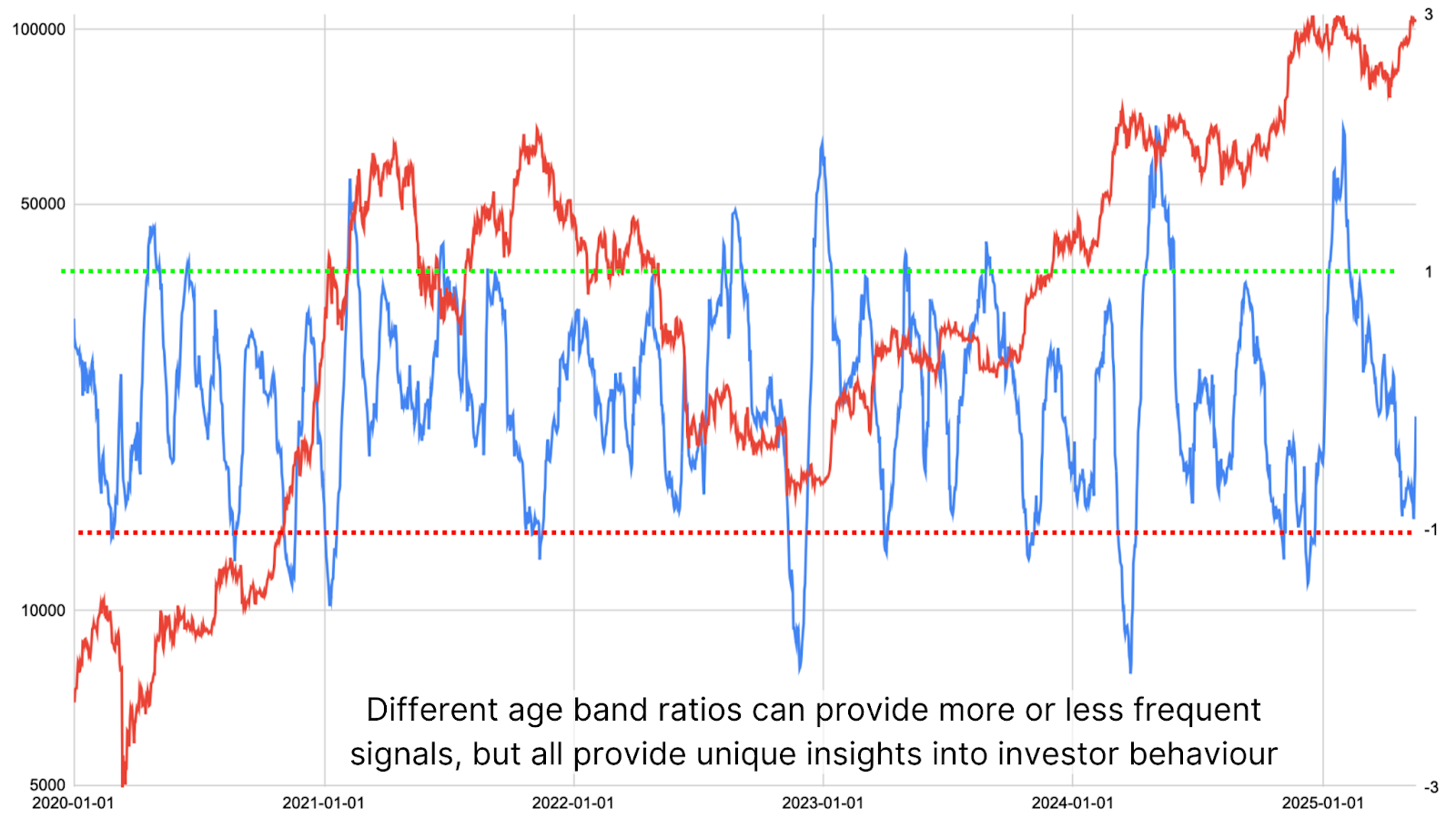

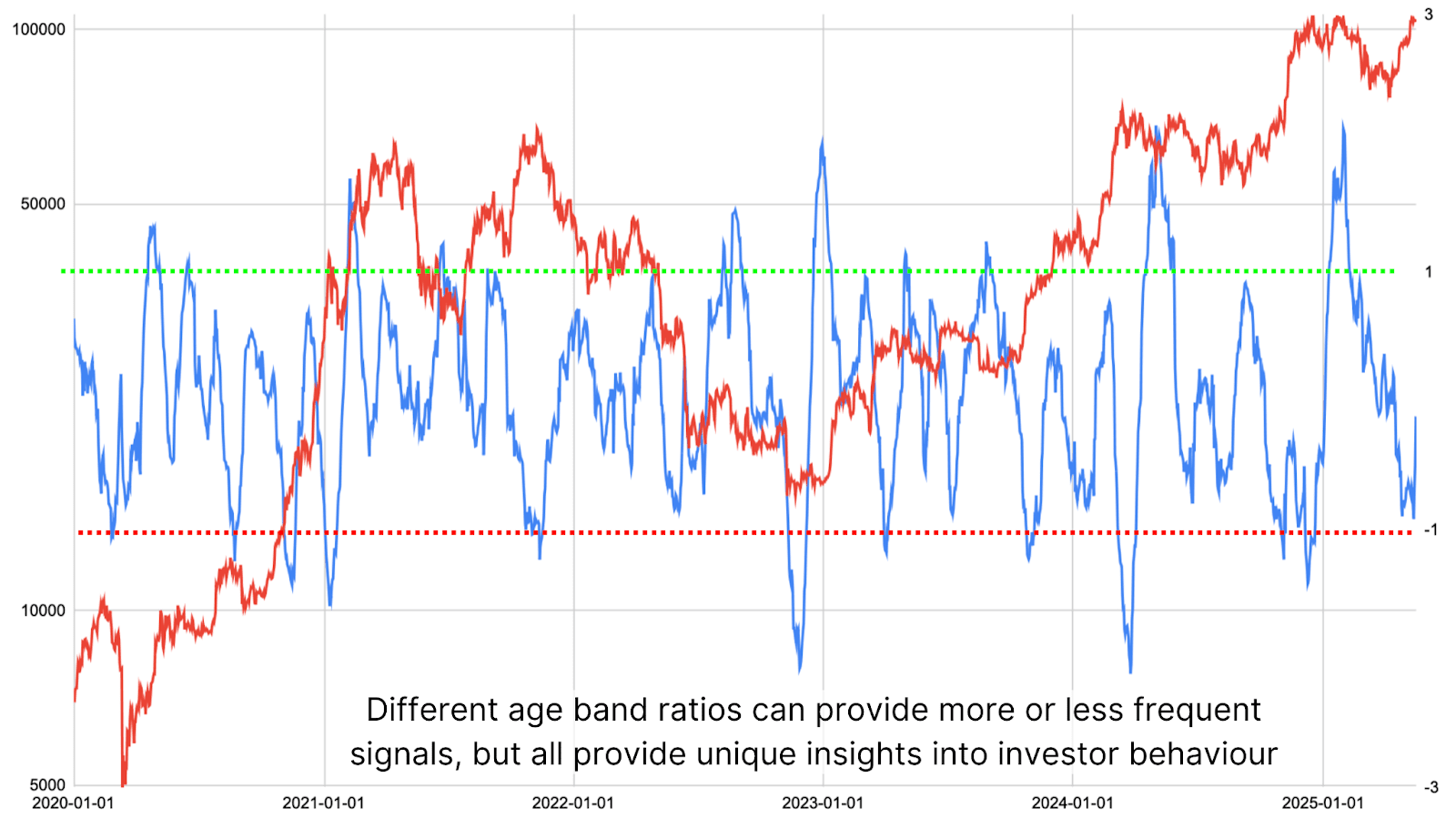

To improve the accuracy of these signals, the data can be slid more precisely by comparing very recent participants (0-1 months holders) against those holding BTC for 1-5 years. This age band comparison provides more frequent insight into real time in distribution patterns.

Figure 5: An age band distribution relationship provides valuable market insight.

We find that sharp decreases in the 1-5 year old proprietor ratio compared to recent participants have historically in line with Bitcoin tops, meanwhile, rapid climbs in the relationship signal that more BTC is flowing in the hands of experienced investors is often a precursor to greater price choices.

Ultimately, monitoring of long -term investor behavior is one of the most effective ways to measure market mood and sustainability of price movements. Long -term proprietors are historically out of short -term dealers by buying under fear and keeping through volatility. By examining the age-based distribution of BTC holdings, we can get a clearer overview of potential tops and bottoms on the market without relying on price action or short-term mood.

Conclusion

As it stands, there is only a smaller level of distribution among long -term owners, nowhere near the scale that historically signales cycle stops. Profit recorder occurs, yes, but at a pace that occurs completely sustainable and typical of a healthy market environment. Given the current phase of the Tyrcycle and the location of institutional and retailers, the data suggest that we are still within a structurally strong phase, with room for further price growth when new capital flows are in.

For more depth of research, technical indicators, real -time market alerts and access to a growing community of analysts, visit Bitcoinmagazinepro.com.

Disclaimer: This article is for information purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.