Larry Fink, CEO of BlackRock, recently speculated that Bitcoin could potentially reach values as high as $700,000 per share. BTC. This projection comes amid growing concerns about currency depreciation and global economic instability, positioning Bitcoin as a hedge against vulnerabilities in traditional financial systems. Fink’s remark was not an outright endorsement, but rather a reflection on a recent meeting he had with a sovereign wealth fund. The fund sought advice on whether to allocate 2% or 5% of its investment portfolio to Bitcoin. According to Fink, if institutional adoption continues to grow and similar allocation strategies are widely embraced, market dynamics could propel Bitcoin to such remarkable heights.

Fink made this striking statement during a recent interview, explaining that Bitcoin’s potential for exponential growth is closely linked to fears of economic downturns and fiat currency devaluation. Fink described Bitcoin as an “international instrument” capable of mitigating local economic fears.

JUST IN: $11.5 trillion BlackRock CEO Larry Fink says Bitcoin could go up to $700,000 if there are more fears of currency depreciation and economic instability.pic.twitter.com/WOXclAsjDP

— Bitcoin Magazine (@BitcoinMagazine) 22 January 2025

A message to the market

With BlackRock managing $11.5 trillion in assets, Fink’s words carry significant weight and send a clear message to both retail and institutional investors. His approval transcends personal opinion and serves as a market signal about Bitcoin’s potential trajectory. Bitcoin has long been heralded as “digital gold” and is seen as a store of value that can protect wealth from inflation and government fiscal mismanagement. Fink’s recognition of this narrative may further accelerate its adoption among traditional investors.

Related: From Laser Eyes to Upside-Down Images: The New Bitcoin Campaign to Flip Gold

A timely forecast

Fink’s prediction comes as global economies struggle with rising inflation, escalating sovereign debt and geopolitical tensions that threaten currency stability. Bitcoin, with its fixed supply of 21 million coins and decentralized structure, presents an alternative asset class that is immune to the inflationary pressures inherent in fiat currencies. In this climate, its value proposition becomes increasingly compelling.

BLACKROCK IS BACK.

THEY JUST BUYED $600 MILLION BITCOIN, THEIR BIGGEST PURCHASE SO FAR THIS YEAR. pic.twitter.com/QLAm5eaik4

— Arkham (@arkham) 22 January 2025

BlackRock’s Bitcoin ETF: A Signal of Institutional Interest

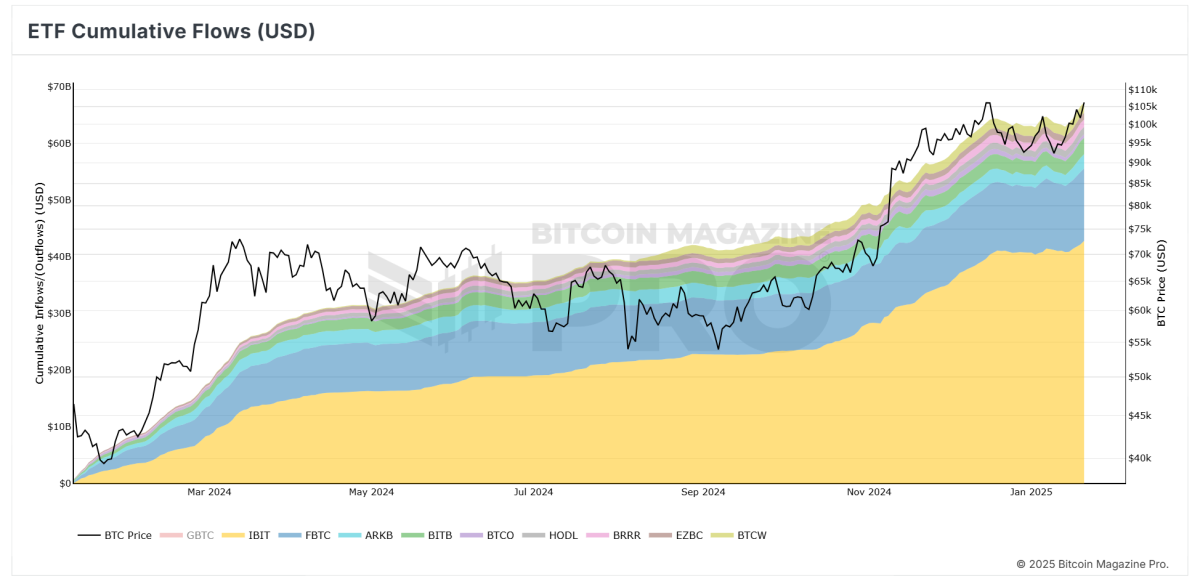

BlackRock’s deepening involvement in Bitcoin reached a milestone on January 21, 2025, when the firm bought $662 million worth of Bitcoin for its exchange-traded fund (ETF), its biggest daily purchase so far this year.

BlackRock’s iShares Bitcoin Trust (IBIT) surpassed the firm’s iShares Gold Trust (IAU) in net assets in October 2024. This milestone was achieved just months after IBIT’s launch in January 2024, highlighting the rapid growth and increasing investor interest in Bitcoin-focused exchange-traded funds.

A balanced perspective

While Fink’s projection is undeniably bullish, it remains contingent on the continuation of current economic trends. If global economic stability improves or innovative financial systems emerge to alleviate fears of currency depreciation, Bitcoin’s price trajectory may stabilize at a lower level. Nevertheless, Fink’s high-profile comment underscores its growing role as a legitimate asset class.

Related: David Bailey Predicts $1M Bitcoin Price During Trump Presidency

Bitcoin’s next chapter

Bitcoin’s evolution from a niche digital experiment to a mainstream financial instrument is accelerating. Fink’s remarks could signal a defining moment not just for Bitcoin, but for its broader acceptance in traditional finance. For investors and enthusiasts, this is more than a vote of confidence – it is a sign that the integration of Bitcoin into the global financial landscape is not only imminent, but already underway.

As the world watches, Bitcoin’s role in redefining finance continues to grow. Fink’s prediction serves as a reminder that Bitcoin is no longer a fringe, but a crucial player in the future of money.