As Bitcoin continues to show signs of sustained strength, it is worth zooming in on one of the most geared plays on BTC’s long -term thesis: Microstratey (MSTR), recently redirected as “strategy.” In this article, we evaluate the extent of the strategy’s accumulation, examine its risk/reward profile and investigate whether this equity proxy could be founded during a period of better than Bitcoin. With several indicators that converge and capital rotation possibly in progress, this can be a critical inflection point for investors.

Strategy Bitcoin -Accumulation increases to 550,000 BTC

It is clear from our Treasury Company Analytics data that the pace of Bitcoin accumulation after strategy in recent months has been nothing short of remarkable. From the year with about 386,700 BTC, the company now holds over 550,000 BTC, a staggering increase that suggests a clear and conscious strategy to front drive a potential breakout event.

Led by Michael Saylor, this acquisition campaign has been methodical with regular weekly purchases that now raised billions of dollars in dollar costs BTC. The company’s average acquisition costs are near $ 68,500 and translate into a current profit in the market of almost $ 15 billion. With their total consumption now around $ 37.9 billion, the strategy has become the largest business owner of Bitcoin with a wide margin that places itself not only as a participant in this cycle but as a defining player.

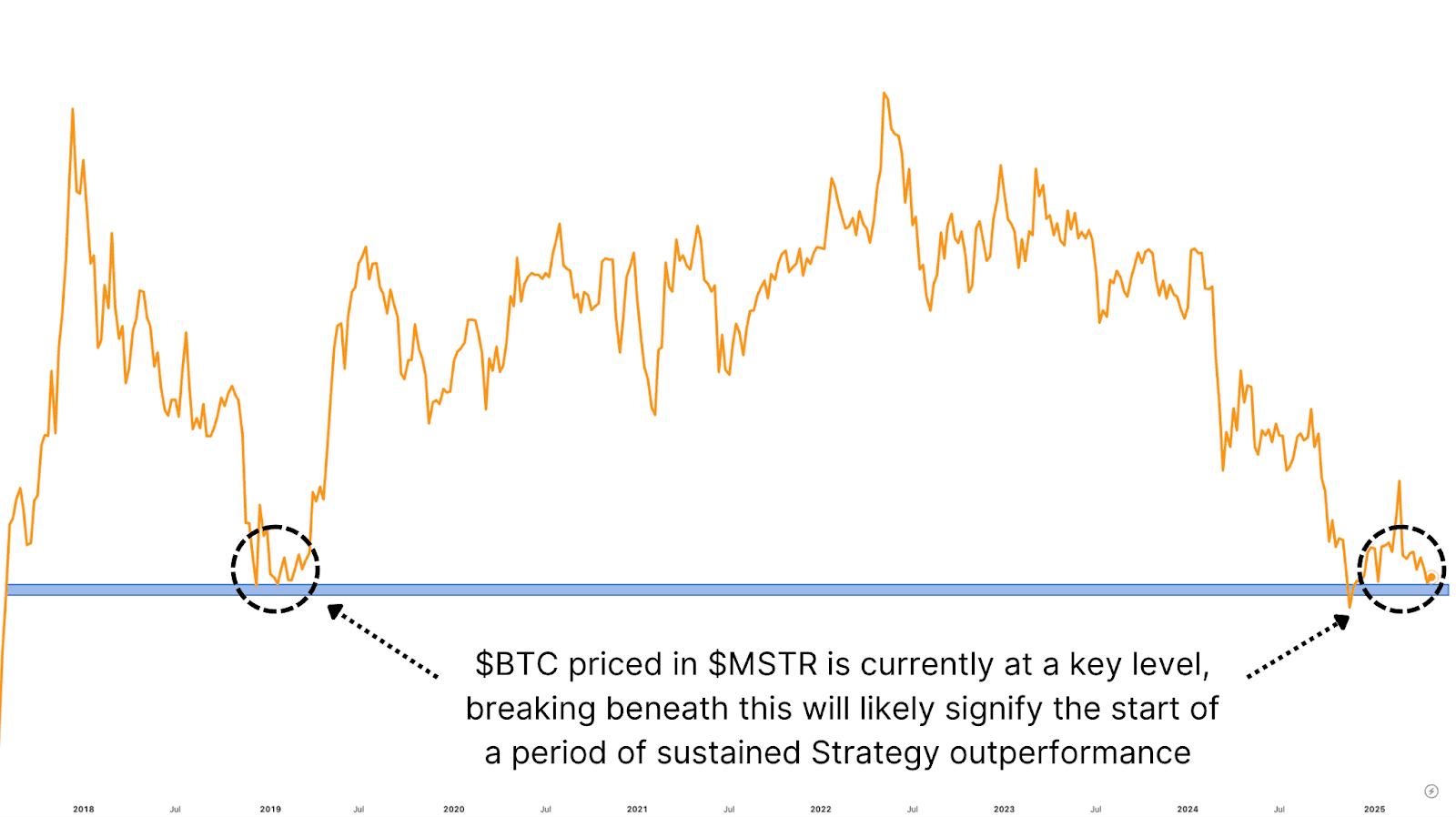

BTC/MSTR -Relationship Signals Mstrs Potential Better Than

Instead of comparing both assets with the US dollar, a more revealing analysis from pricing BTC comes directly in strategy. This relationship provides insight into which of the two assets are relatively better than or lagging.

Right now, the BTC/Mstr ratio sits at a central historical support level and matches the low ones that are set during the Bar -Market Bound 2018–2019. If this level breaks down, it may indicate that the strategy is on the verge of a sustained period of relative strength versus BTC itself. Conversely, a jump from this support suggested that Bitcoin could resume dominance and offer the better mid-term risk/reward.

This chart alone is worth looking closely over the coming weeks. If the relationship confirms a breakdown, we can see significant capital rotation against strategy, especially from institutional allocation seeking exposure to a high-Beta BTC authority with public market access.

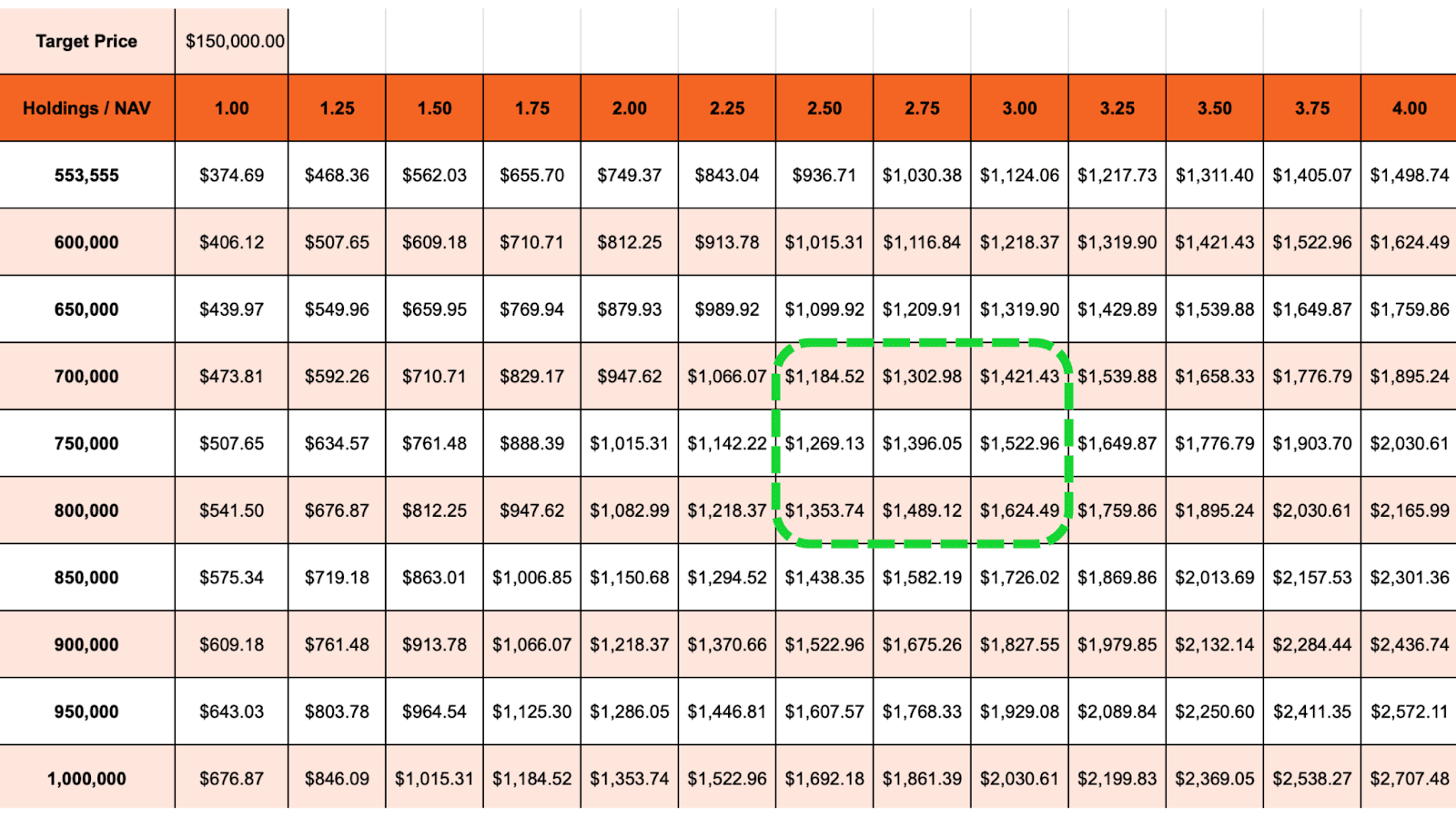

Mstr prism target: $ 1,200- $ 1,600 with Bitcoin’s 2025-rally

While it is impossible to predict accurate results, we can extrapolate forward from the current course of the strategy and apply plausible Bitcoin cycle assumptions. With their current acquisition, the strategy is on its way to the end of 2025 with between 700,000 and 800,000 BTC. If Bitcoin collects $ 150,000, a regular projected top for this cycle, and we use a net worth of 2.5x to 3x (in accordance with historic precedent reaching as high as 3.4x), this would give an expected share price between $ 1,200 and $ 1,600.

These numbers point to a very favorable asymmetrical setup, especially compared to Bitcoin itself. Of course, this projection assumes persistent bullish relationship. But even under more conservative scenarios, math supports the idea that the strategy has a meaningful upside, albeit with more volatility.

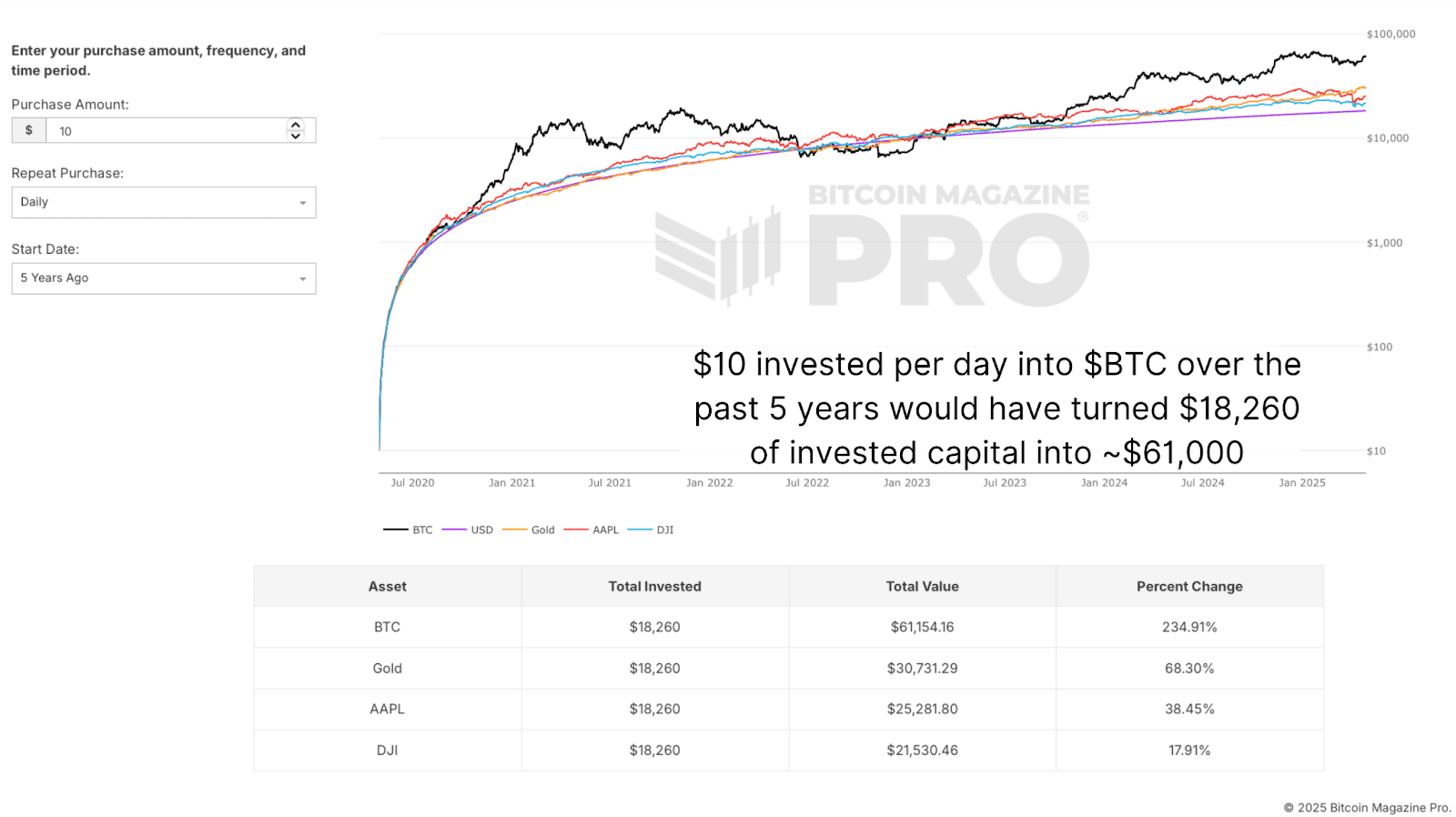

Strategy: High-Beta Proxy to Bitcoin’s Surge from 2025

To further strengthen this case, we can compare historical dollar cost-average results between BTC and strategy. Using the Dollar Cost average strategy tool you can see that if you had invested $ 10 daily in Bitcoin for the past five years, you would have contributed a total of $ 18,260, now worth over $ 61,000. It is an impressive result that surpasses almost any other asset class, including gold, which in itself has risen to new high times recently.

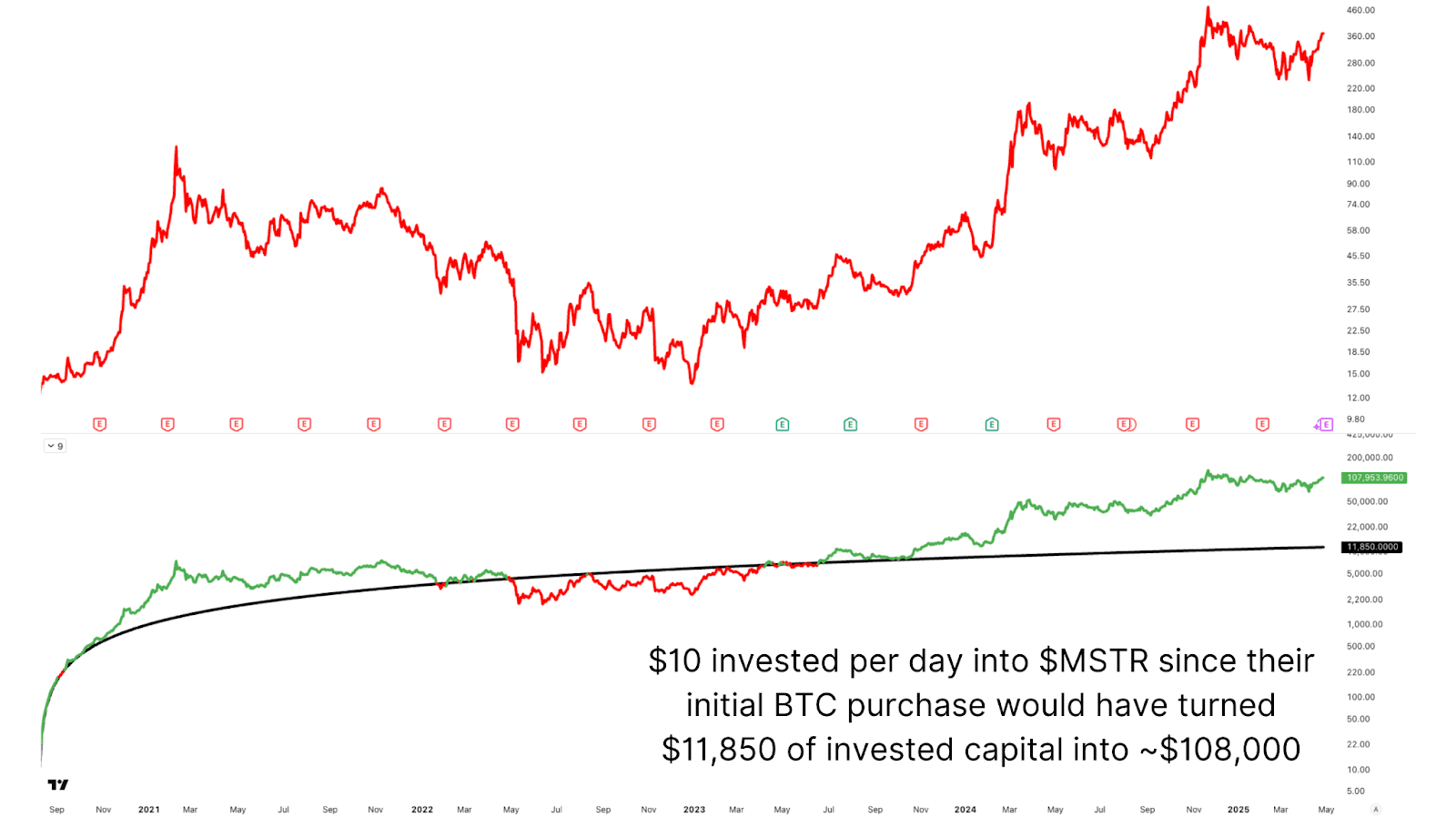

The same $ 10/day strategy used for strategy stock since its first BTC purchase in August 2020 would have resulted in an investment of $ 11,850. This position would now be worth approx. $ 108,000, which surpasses Bitcoin significantly over the same window. This shows that although BTC remains the basic thesis, the strategy has offered even more upside to investors who are willing to mute the volatility.

It is important to recognize that the strategy is effectively an instrument with high beta tied to Bitcoin. This correlation reinforces gains, but it also reinforces loss. If Bitcoin were to go into a prolonged retracement, says a correction of 50% to 60%, the strategy’s share could fall significantly more. This is not just hypothetical. In previous cycles, Mstr has exhibited extreme swings, both for the head and the disadvantage. Investors who consider it as part of their allocation must be comfortable with higher volatility and the potential for deeper drawings during periods of wider BTC weakness.

Why mstr could lead Bitcoin’s 2025 -Rally as a top proxy

So is strategy worth considering as part of a diversified crypto-forward investment portfolio? The answer is yes, but with warnings. Given its close wound conditions with Bitcoin, strategy offers improved upward potential through leverage as well as a historically validated return profile that has surpassed BTC even in recent years. But it comes with the exchange of greater risk, especially in turbulent markets.

The current BTC/MSTR ratio sits at a technical turn. A collapse would signal in -depth better than strategy. However, a rejection can confirm Bitcoin as the more favorable asset in the short term. Either way, both assets remain important to look at. If this cycle enters a renewed phase of strength, you can expect significant institutional capital to flow into both BTC and its most prominent power of attorney, strategy. The rotation can be quick, aggressive and rewarding for those placed early.

For more depth of research, technical indicators, real -time market alerts and access to a growing community of analysts, visit Bitcoinmagazinepro.com.

Disclaimer: This article is for information purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.