This article is based on research and analysis originally presented by Matt Crosby of Bitcoin Magazine Pro.

Bitcoin has made waves in recent weeks, with the Bitcoin price that rose past $ 95,000 after months of defective performance. For many traders and investors, this shift marks the return of the bull market that is long awaited. The question of everyone’s mind: Can Bitcoin finally break its earlier height of $ 108,000, or is this just another fleeting rally?

In this article, we examine the factors that drive Bitcoin’s recent momentum, delve into the technical data and on-chain data and discuss the wider macroeconomic context to measure whether the leading cryptocurrency can maintain this bullish race.

A quick rebound: Bitcoin’s recent wave

Bitcoin’s award had previously experienced a significant dip of over 30%that fell from its highest height of $ 100,000+ into the range $ 70,000. After a period of uncertainty, however, the king of cryptocurrencies has regained his foot and risen back in $ 90,000. This price extraction comes after a multi-month consolidation phase that many saw as a bearish market structure. But the recent development suggests that Bitcoin could be at the forefront of a larger outbreak, supporting a renewed wave of Bitcoin prize prediction models that come into the discussion.

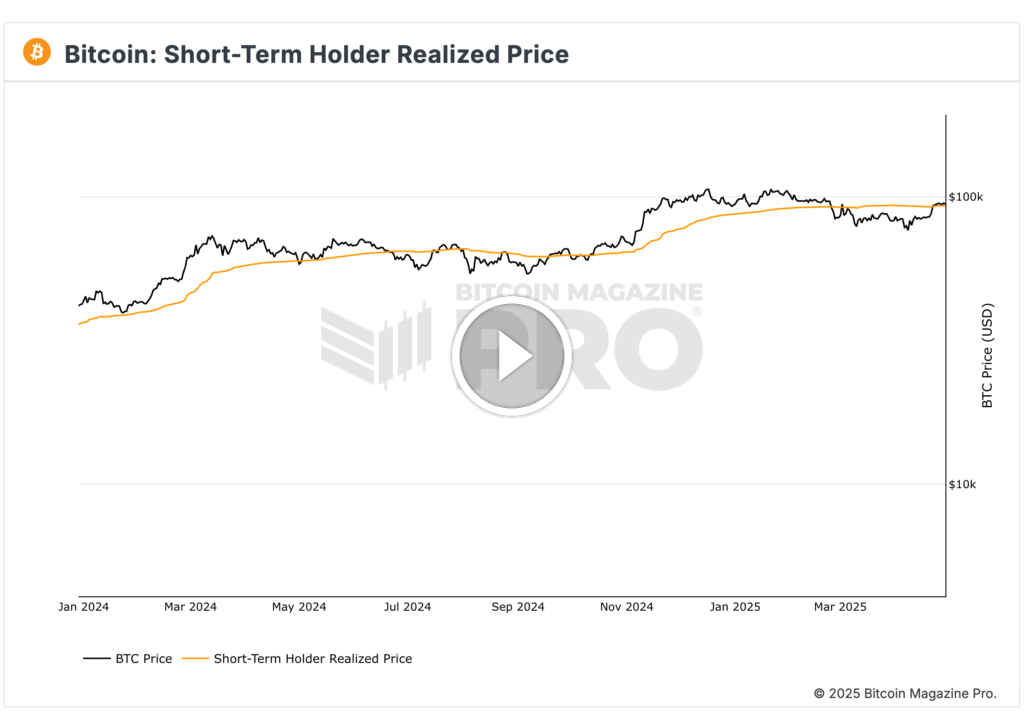

Bitcoin’s price action has recently regained several key levels, including the critical short -lived proprietor realized award (STH realized price), which is often seen as an important signal of market power. Historically, during bull markets, the short -lived proprietor of the award realized as a level of support. When this metric lashes from resistance to support, it typically indicates a sturdy foundation for further movement upwards.

Over the past few weeks, Bitcoin Price (BTC) has regained the level of about $ 93,000 to $ 95,000, signaling that the market could be ready for a more extensive rally. Given that former Tyrcycles have seen similar behavior after recovering key price levels, many are beginning to feel more and more bullish to the potential for a new highlight of all the time in 2025.

On-Chain Data: The Bullish Signs of Market Strength

When you analyze Bitcoin, it is not only the price action that means something-it is also the on-chain data. This data helps us understand the behavior of market participants and provides insight into the health of the network. The recent shift in the long -term holder supply is such an indicator pointing to Bitcoin’s strengthening views.

For the past few months, Bitcoin had experienced an unusual pattern in which long -lasting proprietors (those who have been holding Bitcoin for over a year) actively sold their inventory, potentially locked in the profits. This had led to many concerning that Bitcoin’s award was close to its peak. However, recent data shows a reversal in this trend. Long-term holders have begun to accumulate again, which is often a strong bullish signal in a Bitcoin market cycle. Historically, when long -term holders switch to accumulation mode, it typically marks the beginning of a new bull phase.

In addition, the presence of ETF flow further strengthens this optimistic vision. For the past few weeks, Bitcoin ETFs have seen hundreds of millions of dollars flow into them, indicating growing institutional confidence in Bitcoin. These influxes come in the middle of a period when traditional markets, such as the S&P 500, have been exposed to volatility, but Bitcoin has managed to keep its soil and even rally despite wider market corrections.

The role of the market survey: why this step feels different

There is a basic shift that takes place in the Bitcoin market right now, one that suggests that this is not just another short rally. Bitcoin’s current upward momentum seems to be driven primarily by spot -driven purchases, rather than over geared trade. When Bitcoin’s price rises due to increased demand for demand instead of excessive leverage, the move is typically more sustainable and less prone to sharp twists.

One of the most important driving forces for this more organic upward pressure from the Bitcoin price has fallen into the US Dollar Strength Index (DXY). Over the past few weeks, DXY has fallen and signaled a decrease in demand for the dollar. This trend has made risk-on assets like Bitcoin more attractive. As global liquidity has risen due to various monetary policy actions, Bitcoin stands to take advantage of this wider market trend. The reduction in the dollar’s strength also signalizes a potential shift in investor mood, with more capital flowing into assets that can transition in a weaker dollar environment.

In addition, Bitcoin’s connection with traditional stock markets, especially the S&P 500, has been a key factor to monitor. In large parts of 2023, Bitcoin has shown a strong positive correlation with the stock market. This means that when the S&P 500 competitions, Bitcoin tends to follow. The latest pricing has shown that Bitcoin has been able to keep its land despite a temporary dip in the stock markets, which further suggests that the bullish mood in Bitcoin could be maintained, especially if traditional markets continue to rebound.

Macrofactors: State of Global Liquidity

The wider financial context cannot be ignored. Massive amounts of liquidity were injected into global markets from 2020 to 2022 of central banks. While this liquidity originally ran activ inflation across all markets, it now shows signs of positively affecting Bitcoin as well.

Bitcoin has historically correlated with global liquidity trends, and recent data suggests that the increased liquidity of the financial system is finally beginning to affect the cryptocurrency market. Bitcoin’s recent wave coincides with this rising liquidity, which further strengthens the case for a more long -lasting bullish phase.

However, there is still a crucial factor to consider: the state of global equities and their potential to influence Bitcoin’s award. While the S&P 500, while showing a strong rebound, is still facing resistance at key levels. Bitcoin’s award has been closely linked to the wider benefit of shares, and if the stock market is facing further turbulence, it can also dampen Bitcoin’s prospects.

What is next for Bitcoin: $ 100,000 and over?

The $ 100,000 level is the immediate target of the Bitcoin award, but the real question is: Can it break through this resistance and push into new high territory for all the time? The recent recycling of key levels, such as the short-lived proprietor, realized price and the moving average (100-day, 200-day, 365-day), show that Bitcoin is in a strong position to test $ 100,000 again.

From a technical perspective, Bitcoin is currently at a crucial time. If it can accommodate over $ 90,000- $ 95,000 and continue to build support, the path towards new high times becomes more and more likely. The next big resistance is likely to be about $ 108,000, which is the current high time. If Bitcoin can break through this level, we could see a quick movement towards higher levels – potentially reaching as high as $ 130,000 in the next cycle.

However, there is always the possibility of a retracement. If Bitcoin does not keep its support levels or if the global market conditions become Bearish, we could see the price fall back in the $ 80,000 series. A bearish gene test would be a critical moment for the market as the failure to recover support could set the stage for more significant disadvantage.

Conclusion: A bullish sight with cautious optimism

All signs point to a potentially Bitcoin rally with strong data on the chain, a favorable macro environment and positive atmosphere in the derivatives. However, the key to maintaining this Bullish Momentum lies in Bitcoin’s ability to keep its current support levels and navigate potential market councils. The strong correlation with the S&P 500 remains a decisive factor to look at as any downturn in shares can affect Bitcoin’s price action.

In the coming weeks, all eyes will be at Bitcoin’s ability to recover $ 100,000 and set the stage for new high times. While there is plenty of room for optimism, dealers should remain vigilant and prepared for any potential volatility. As always, the key to success in the crypto market is to remain data -driven and adapt to market conditions as they develop.

Visit Bitcoinmagazinepro.com to explore live data and stay informed about the latest analysis.

Disclaimer: This article is for information purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.