Bitcoin’s journey from 2025 has not delivered the explosive bull market that many expected. After peaking over $ 100,000, 2025 Bitcoin Price was back sharply to as low as $ 75,000, triggering debate among investors and analysts about where we are in the Bitcoin cycle. In this analysis, we cut through the noise, utilize indicators and macro data to determine whether the Bitcoin Bull market remains intact, or whether a deeper Bitcoin correction is velted in the 3rd quarter of 2025.

Is Bitcoin’s withdrawal of 2025 Healthy or Tyrcycle?

A strong starting point for assessing the 2025 Bitcoin cycle is MVRV Z-score, a trusted on-chain indicator comparing the market value with realized value. After hit 3.36 on Bitcoin’s $ 100,000 top, MVRV Z-score dropped to 1.43, adapting the Bitcoin price drop from $ 100,000 to $ 75,000. This 30% bitcoin correction may seem alarming, but recent data shows MVRV Z-score rebounding from its 2025 low at 1.43.

Historically, MVRV Z-score levels around 1.43 have marked local bottom bottoms, not tops, in previous Bitcoin bull markets (eg 2017 and 2021). These Bitcoin strikes often went ahead of resumed appearances, suggesting that the current correction is in accordance with healthy bull cycle dynamics. While investor scaffolding is shaken, this step fits the historical patterns of the Bitcoin market cycles.

How smart money forms 2025 Bitcoin Bull Market

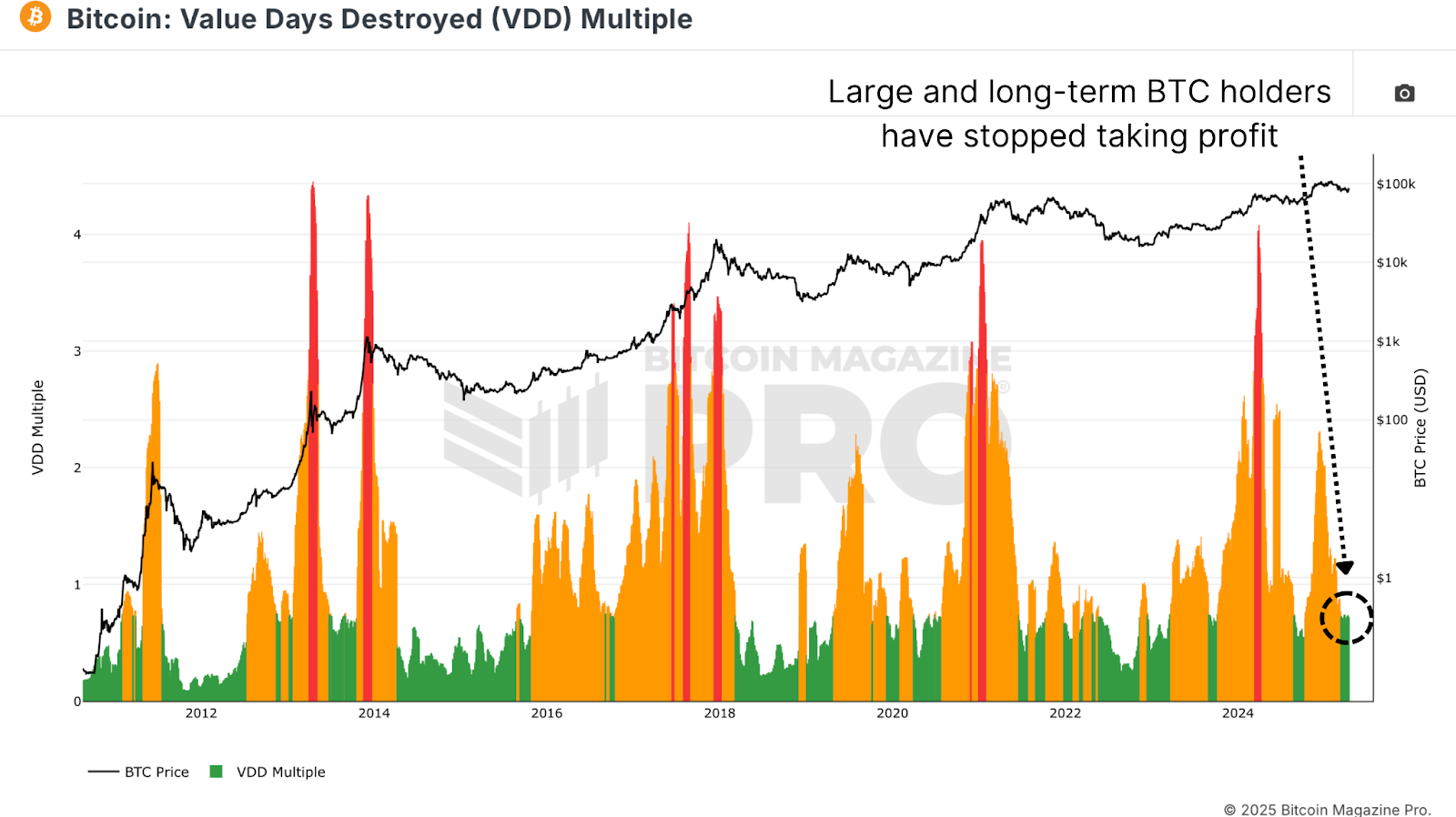

The days of value destroyed (VDD) Multiple, another critical indicator of the chain, tracks the speed of BTC transactions weighted by holding periods. Spikes in VDD signal profits from experienced holders, while low levels indicate Bitcoin accumulation. Currently, VDD is in the “green zone” that reflects levels seen in late bear markets or early bull market.

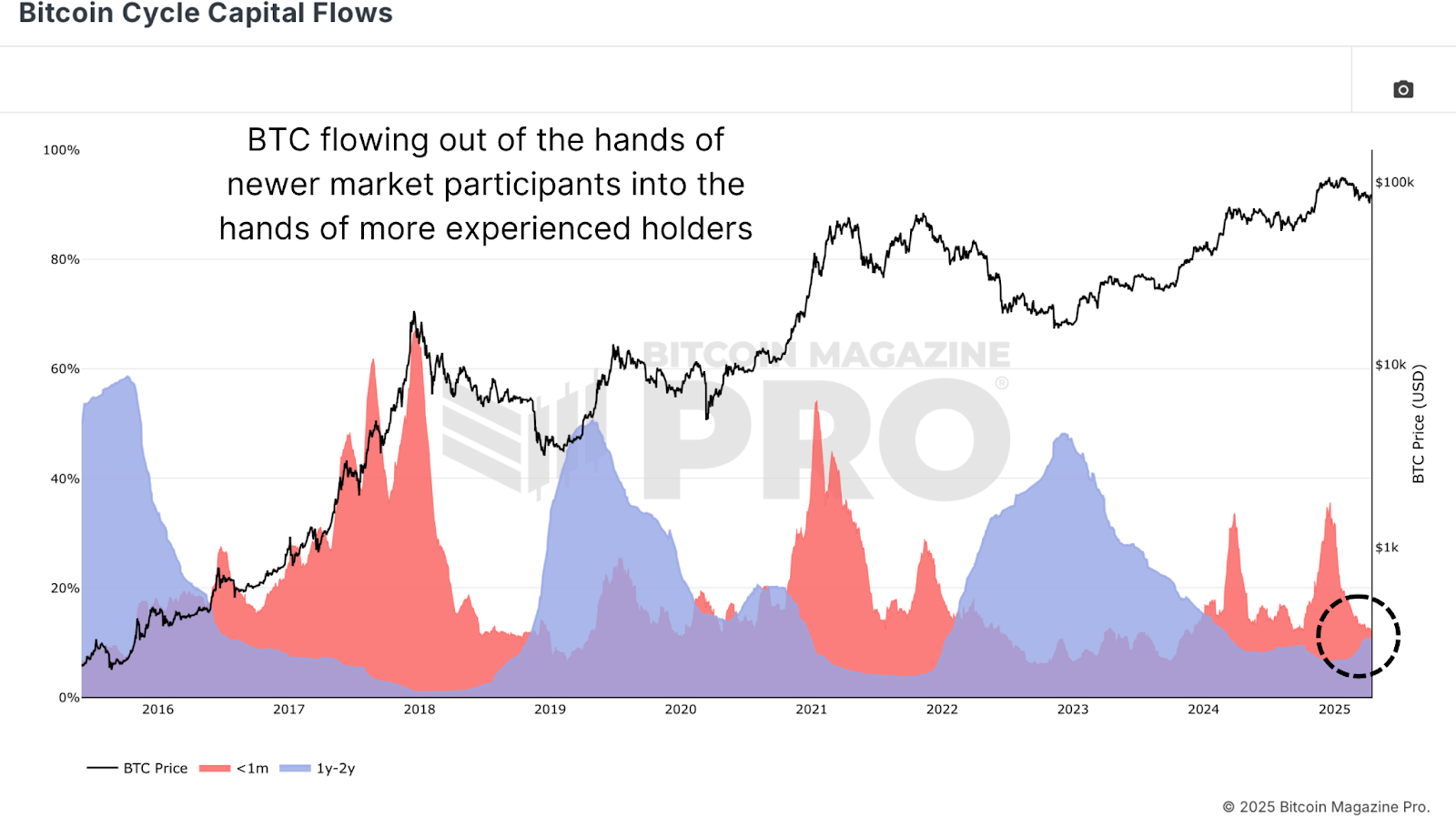

Following Bitcoin’s reversing from $ 100,000, the low VDD suggests the end of a profit tag phase where long-term holders gathered in the expectation of higher 2025 Bitcoin prices. Bitcoin Cycle Capital Flows diagram illuminates this trend further and breaks down realized capital by coins. Near the top of $ 106,000 new marketers (<1 month) ran an increase in activity signaling Fomo-driven purchases. Since the Bitcoin tension, this group's activity has cooled to levels typically too early for middle bull markets.

In contrast, the 1-2-year-old Kohort-Ofte Macro-capable Bitcoin investor activity increases that accumulates at lower prices. This shift mirrors Bitcoin accumulation patterns from 2020 and 2021, when long-lasting holders bought under DIPs that set the stage for bullcycle targets.

Where are we in 2025 Bitcoin Market Cycle?

Zooming out can the Bitcoin market cycle be divided into three stages:

- Bear phase: Deep Bitcoin corrections of 70-90%.

- Recovery Phase: Recovery of previous heights all the time.

- Bull/Exponential Phase: Parabolic Bitcoin prize development.

Former Bear Markets (2015, 2018) lasted 13-14 months, and the latest Bitcoin Bear market followed after 14 months. Recovery phases typically span 23-26 months, and the current 2025 Bitcoin cycle decreases within this interval. Unlike previous bull markets, Bitcoin’s breakout of previous heights was followed by a withdrawal rather than an immediate increase.

This Bitcoin strike can signal a higher low, creating the exponential phase of the 2025 bull market. Based on previous cycle ‘9-11-month exponential phases, the Bitcoin award could top peaks around September 2025, provided the bull cycle is resumed.

Macropran risks affecting the Bitcoin price in 3rd quarter 2025

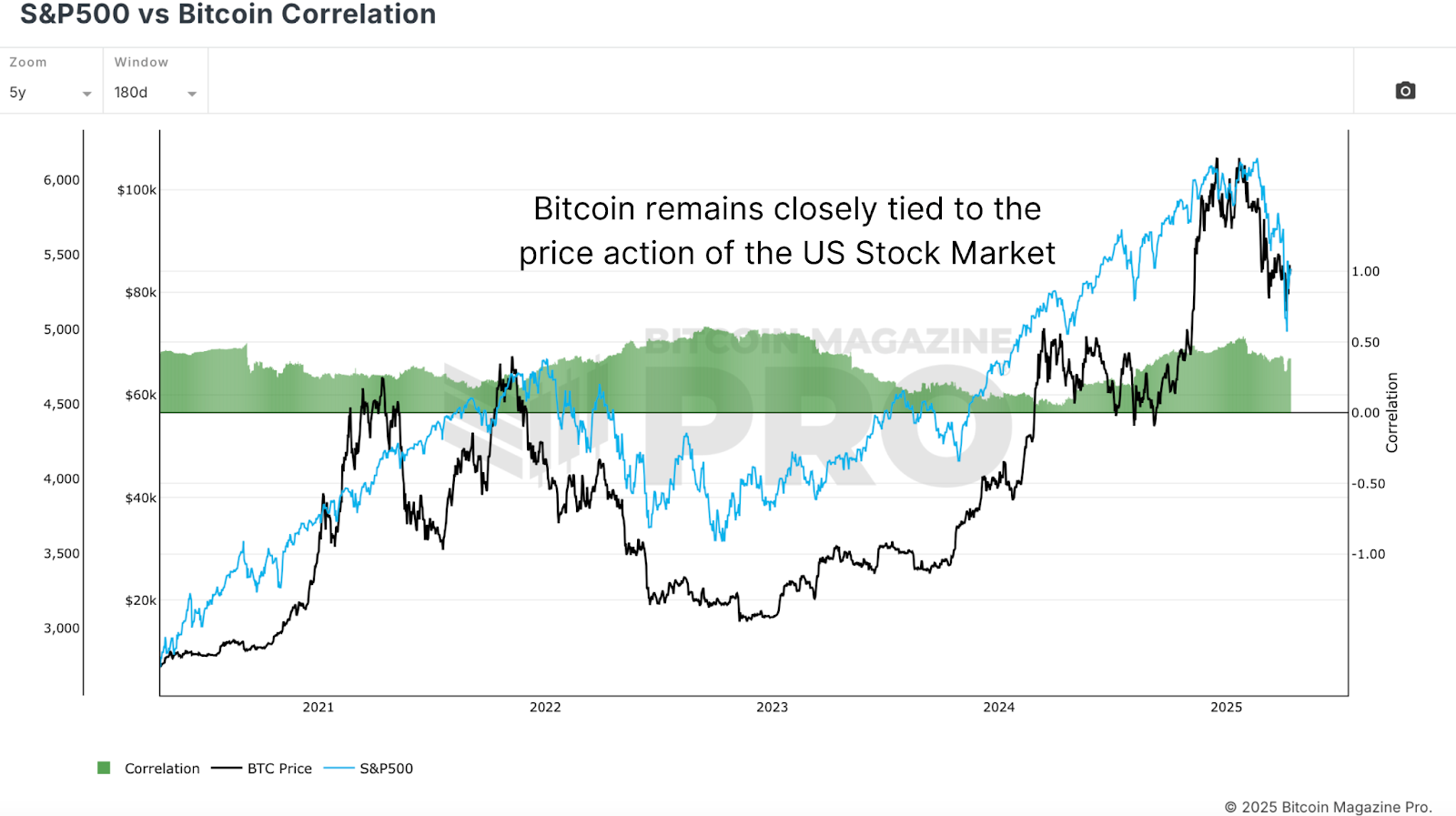

Despite the bullish on-chain indicators, macro gains pose the risks of the 2025 Bitcoin award. S&P 500 vs. Bitcoin correlation diagram shows that Bitcoin remains closely linked to US stocks. With fear that a global recession is growing, weakness in traditional markets could Kaple Bitcoin’s almost term potential.

Monitoring these macro-risks is crucial as a deteriorated stock market can trigger a deeper Bitcoin correction in the 3rd quarter of 2025, although data on the chain remains supportive.

Conclusion: Bitcoin’s Q3 2025 Outlook

The most important indicators on-chain-MVRV Z-score, value days destroyed and Bitcoin-cycle capital streaming point for healthy, cycle-consistent behavior and long-lasting accumulation in 2025 Bitcoin cycle. While slower and uneven compared to previous bull markets, the current cycle is consistent with historic Bitcoin market cycle structures. If macro -conditions are stabilized, Bitcoin looks ready for another leg up, potentially peaking in 3rd quarter or 3rd quarter of 2025.

However, macropropic risks, including volatility and recession of equity, remain critical for seeing. For a deeper dive, watch this YouTube video: Where we are in this Bitcoin cycle.

For more depth of research, technical indicators, real -time market alerts and access to a growing community of analysts, visit Bitcoinmagazinepro.com.

Disclaimer: This article is for information purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.