Bitcoin’s pricing is again catching headlines, and this time the catalyst seems to be global liquidity trends reshape investor mood. In a recent comprehensive collapse, Matt Crosby, the main analyst at Bitcoin Magazine Pro, presents compelling evidence that ties the digital asset’s renewed bullish momentum to the growing global M2 money quantity. His insight not only highlights the future of the Bitcoin award, but also anchores its macroeconomic relevance in a broader financial context.

Bitcoin award and Global Liquidity: A correlation with great influence

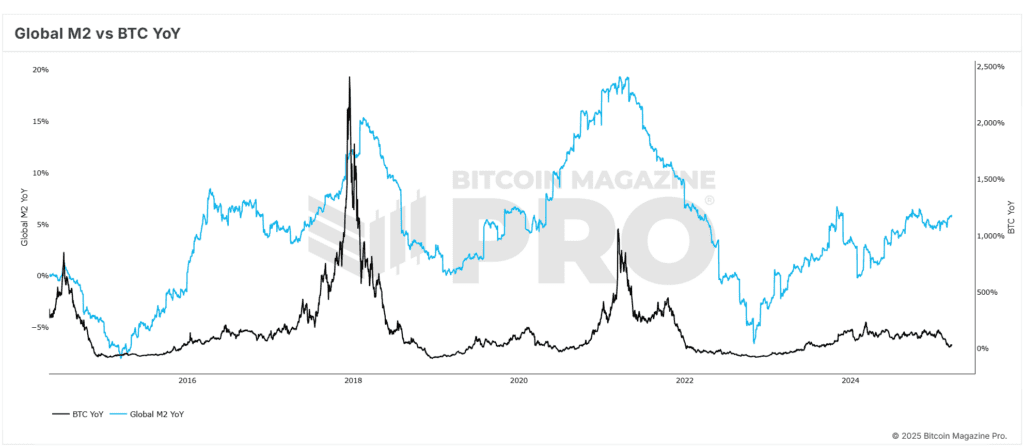

Crosby highlights a remarkable and consistent correlation – often over 84% – between Bitcoin price and global M2 liquidity levels. When liquidity rises over the global economy, Bitcoin Price typically responds with upward movement, though with a noticeable delay. Historical data supports the observation of a 56-60 day delay between monetary expansion and Bitcoin price increases.

This insight has recently appeared exactly as Bitcoin Price Rebounded from low level of $ 75,000 to over $ 85,000. This trend is close to the expected recovery that Crosby and his team had outlined based on macro indicators, which validated the strength and reliability of the correlation that drives the Bitcoin award up.

Why the 2-month delay affects the Bitcoin price

The two-month delay in market response is a critical observation for understanding Bitcoin prize movements. Crosby emphasizes that monetary policy and liquidity injections do not immediately affect speculative assets such as BTC. Instead, there is an incubation period, typically about two months in which liquidity filters through financial systems and begins to affect the Bitcoin price.

Crosby has optimized this context through various backests, adjustment of time frames and shifts. Their conclusions indicate that a 60-day delay provides the most predictable accuracy across both short-term (1-year-old) and expanded (4-year-old) historically Bitcoin preaching. This delay provides a strategic benefit to investors who monitor macro trends to anticipate Bitcoin price increases.

S&P 500 and its influence on Bitcoin -Pristends

Adding additional credibility to the dissertation expands Crosby its analysis to traditional stock markets. The S&P 500 exhibits an even stronger context of approx. 92% with global liquidity. This correlation strengthens the argument that monetary expansion is a significant driving force, not only for Bitcoin award, but also for wider risk-acting classes.

By comparing liquidity trends with multiple indexes, Crosby demonstrates that the Bitcoin price is not an anomaly but part of a wider systemic pattern. As liquidity rises, stocks and digital assets tend to take advantage, making M2 deliver an important indicator of timing Bitcoin price movements.

Forecasts Bitcoin Price for $ 108,000 by June 2025

In order to build a forward-looking perspective, Crosby uses historical fractals from previous bull markets to project future Bitcoin award movements. When these patterns are overlaid with current macro data, the model points to a scenario where Bitcoin Price could gene test and potentially surpass its high times and target $ 108,000 in June 2025.

This optimistic projection for the Bitcoin price is linked to the assumption that global liquidity continues its upward course. The Federal Reserve’s recent statements suggest that additional monetary stimulus could be implemented if market stability bursts – another headwind to Bitcoin price growth.

The speed of expansion affects the Bitcoin price

While increasing liquidity levels are significant, Crosby emphasizes the importance of monitoring the speed of liquidity expansion to predict Bitcoin prize developments. The year to year M2 growth speed offers a more nuanced view of macroeconomic momentum. Although liquidity has generally risen, the expansion pace had slowly decreased before resuming an upward trend in recent months.

This trend is similar to striking conditions observed in early 2017, just before Bitcoin Price entered an exponential growth phase. The parallels reinforce Crosby’s Bullish view of Bitcoin prize and emphasize the importance of dynamic rather than static, macro analysis.

Last Thoughts: Preparing for the next Bitcoin -Price Phase

While potential risks such as a global recession or significant equity market correction continue, the current macro indicators point to a favorable environment for Bitcoin prize. Crosby’s data -driven approach gives investors a strategic lens to interpret and navigate the market.

For those who wish to make informed decisions in an unstable environment, these insights provide action -based intelligence based on financial basic elements to exploit Bitcoin pricing opportunities.

For more depth of research, technical indicators, real -time market alerts and access to a growing community of analysts, visit Bitcoinmagazinepro.com.

Disclaimer: This article is for information purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.