With all the current Bearish atmosphere and macroeconomic uncertainty swirling around both Bitcoin and the wider global economy, it may come as a surprise to see miners as bullish as ever. In this article, we unpack the data that suggests that Bitcoin mine workers do not just remain the course, they accelerate and double at a time when many are withdrawing. What exactly do they know that the wider market may be missing?

For a more in-depth look at this topic, watch a recent YouTube video here:

Why Bitcoin -Mine workers are doubling right now

Bitcoin hash rate goes parabolic

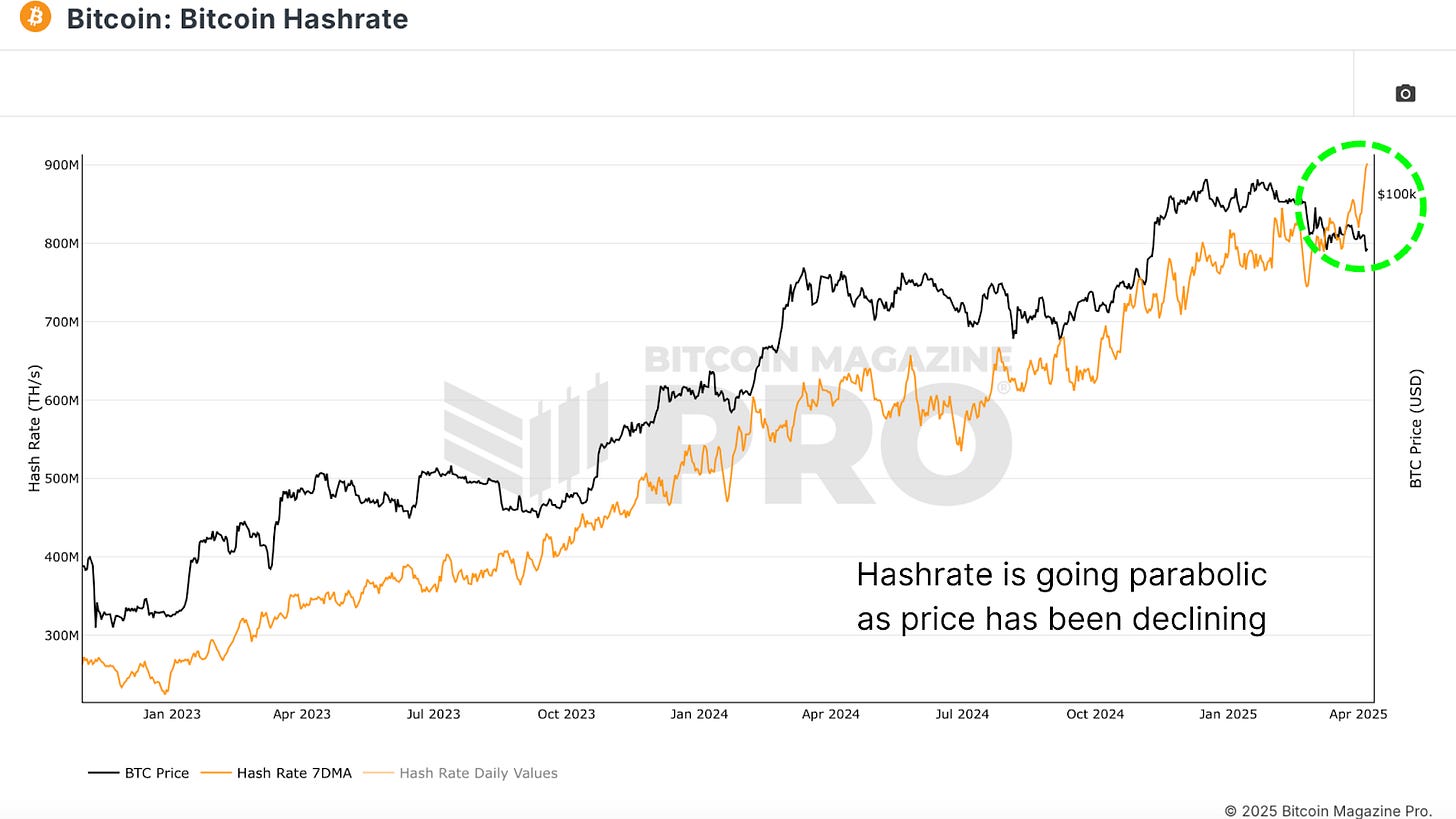

Despite Bitcoin’s recent price underpartion, Bitcoin Hashrate has been absolutely vertical and broken all time heights with apparently no consideration of macro -mind or weak price action. Typically, the hash frequency is densely correlated with BTC price; When the price falls sharply or remains stagnant, the hash frequency tends to plateau or fall due to financial pressure on miners.

But now, in light of increased global tariffs, financial slowdown and a consolidation of the BTC price, the hash frequency is accelerating. Historically, this level of divergence between hash frequency and price has been rare and often significant.

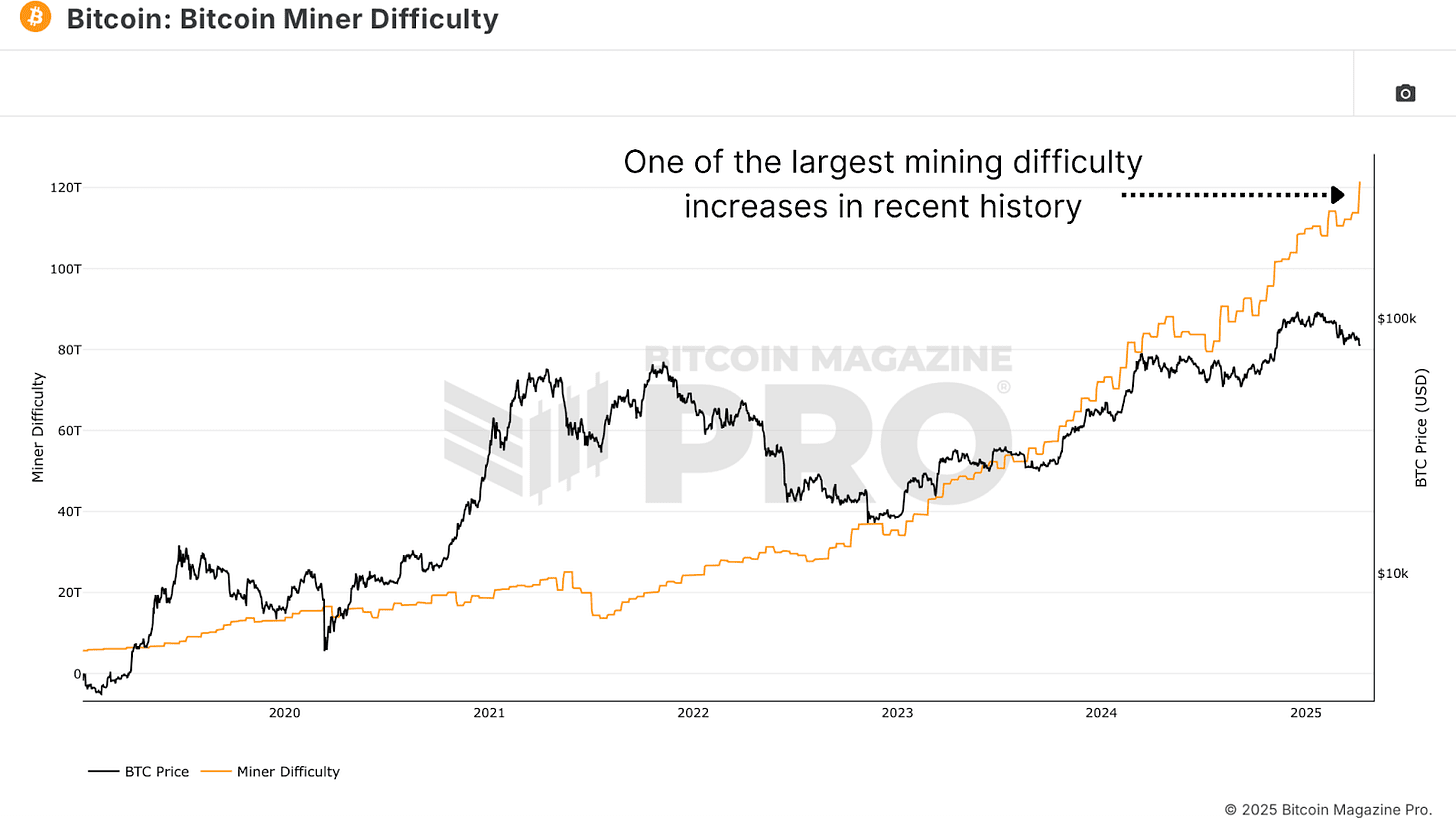

Bitcoin mines -difficulties, a close cousin to hashish, so just one of its largest single adjustments upwards in history. This metric, which automatically adjusts to keep Bitcoin’s block-timing consistent, only increases when multiple computational power floods the network. A severity of this magnitude, especially when paired with poor price performance, is almost unprecedented.

Again, this suggests that miners are investing heavily in infrastructure and resources, even when BTC Price does not seem to support the short -term decision.

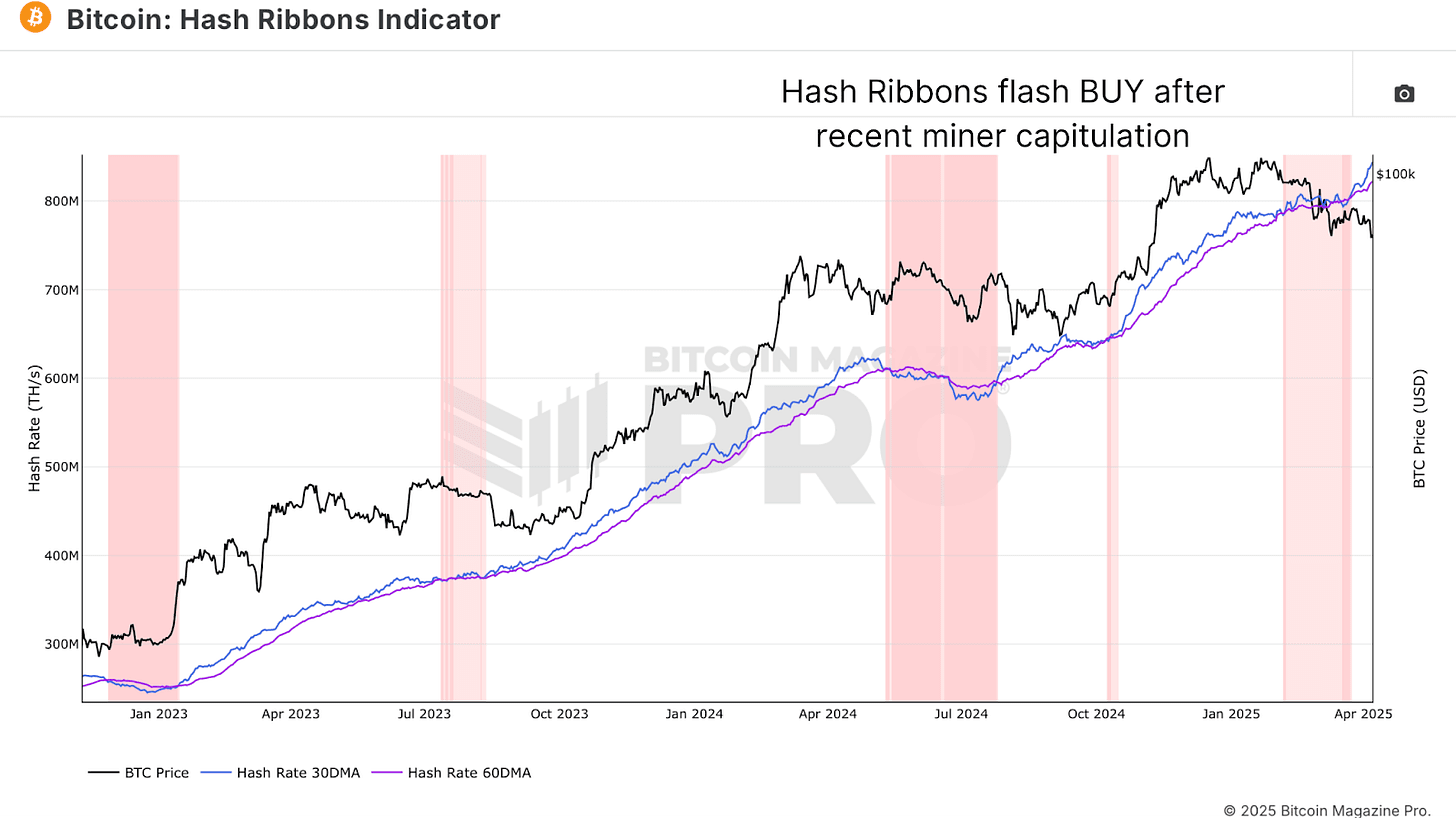

Adding additional intrigue, the hash tape indicator, a mixture of short and prolonged hash frequency that moved average, recently a classic Bitcoin purchase signal.

When the 30-day sliding average (blue line) crosses back over 60-day (purple line), it signalizes the end of miner capitulation and the onset of renewed miner strength. Visually, the diagram’s background is shifted from red to white when this crossover occurs. This has often marked powerful bending points for the BTC price.

What beats this time is how aggressively the 30-day sliding average rises away from the 60th day. This is not just a modest recovery, it is a statement from miners that they are focusing heavily on the future.

The tariff factor

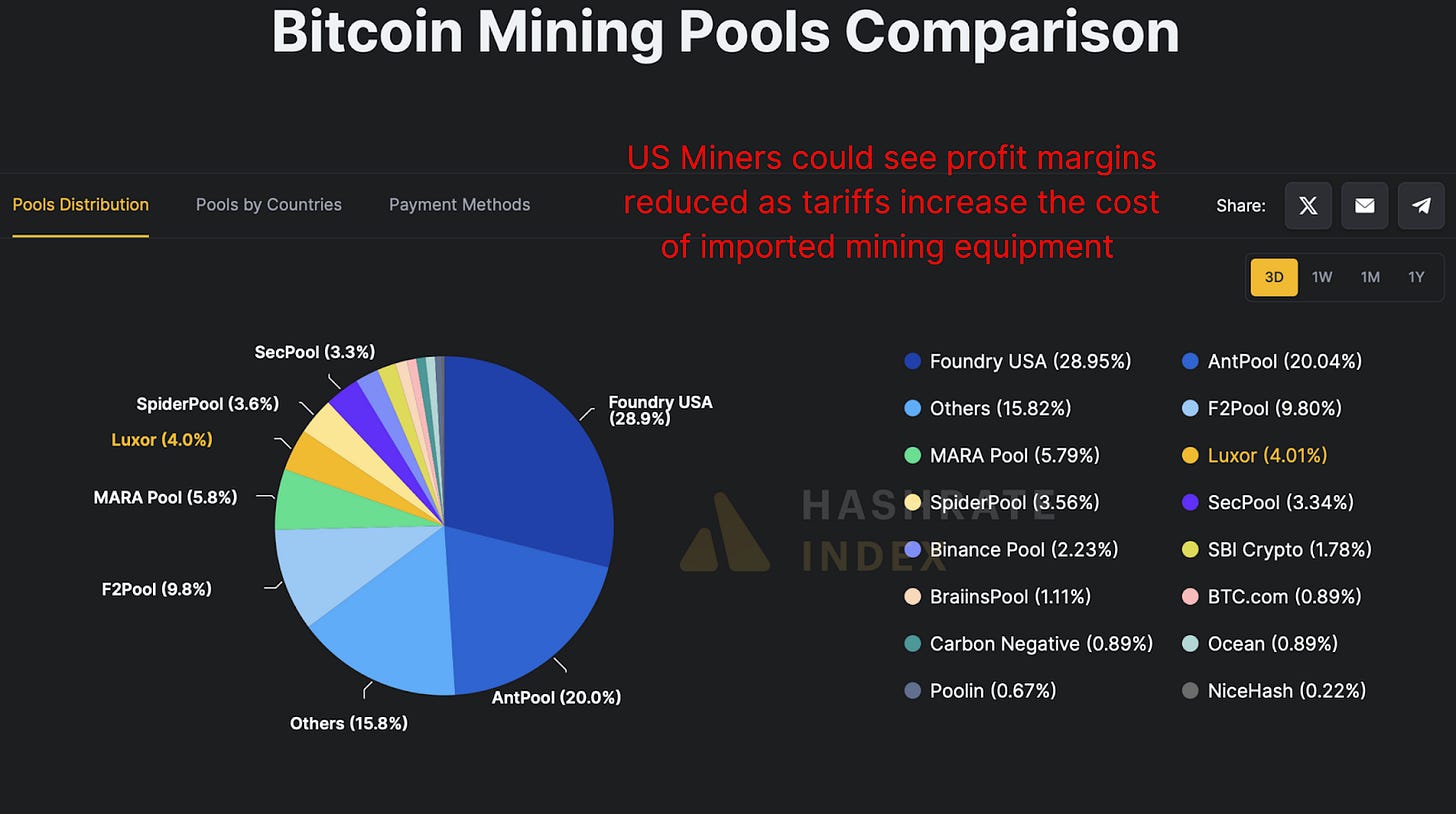

So what is this mines burning -madness? A plausible explanation is that miners, especially US-based, are trying to front the effect of threatening tariffs. Bitmain, the dominant producer of mining, is now in the cross hair in trade policies that could see equipment prices rise by 30-50%, potentially to even over 100%!

Given that over 40% of Bitcoin’s hash rate is controlled by US-based pools such as Foundry USA, Mara Pool and Luxor, any cost increase would drastically reduce the profit margins. Miners can aggressively scale now, while hardware is still (relatively) cheap and accessible.

Bitcoin -Mine workers hold mining

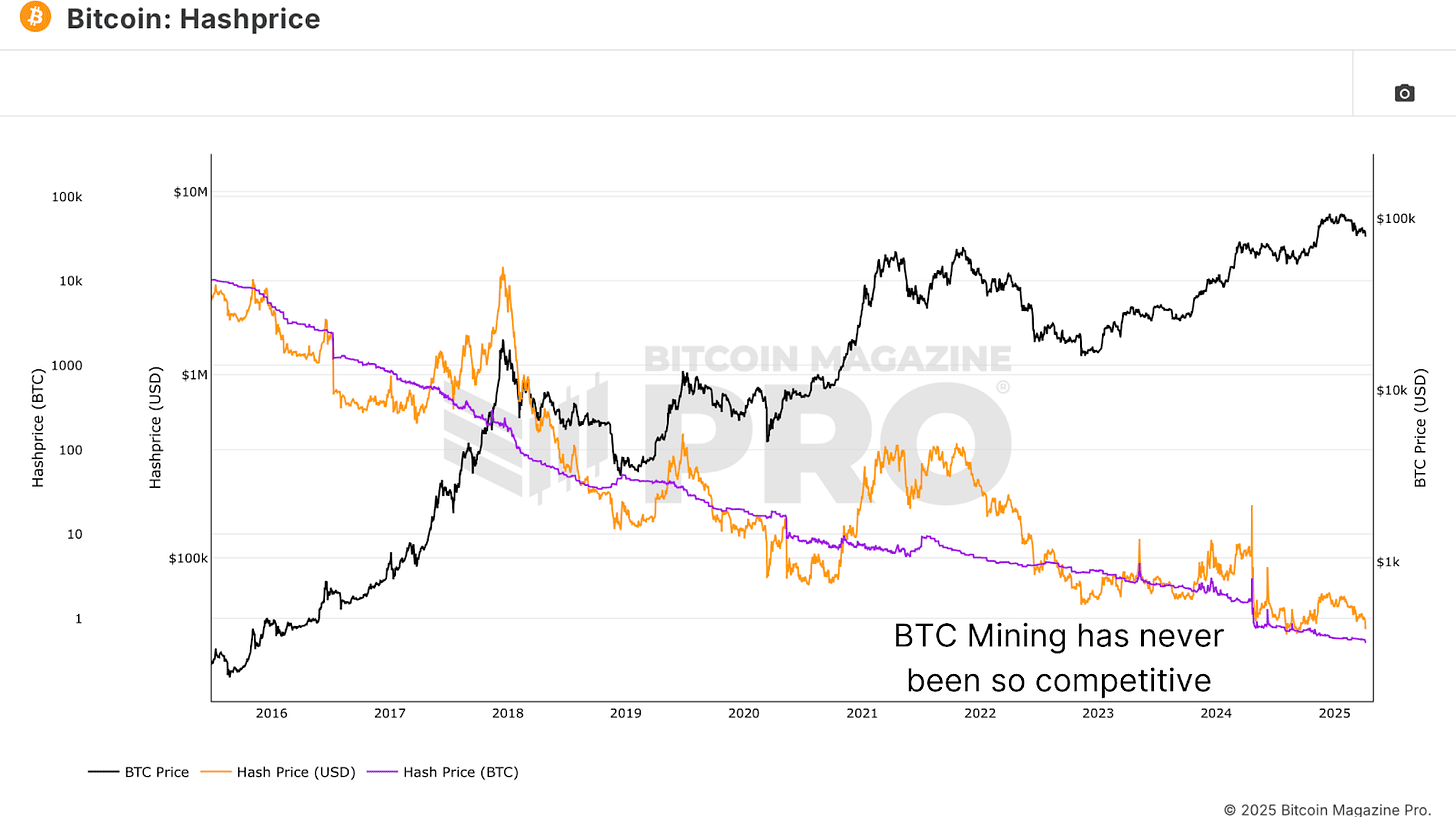

Hashprice, the BTC-denominated income per Terahash of computing power, is on historic low. In other words, it has never been less profitable in BTC terms to operate a Bitcoin miner on a Per-Terahash basis. Typically, we see hashish price rise against the tail end in the bear markets as competition fades and weaker players leave the space.

But it doesn’t happen here. Despite terrible profitability, miners do not only remain online, they implement more hashish power. This could involve one of two things; Either the miners are fighting for deteriorating margins for the front load of BTC accumulation, or more optimistically they have strong beliefs in Bitcoin’s future profitability and buy dipped aggressively.

Bitcoin Miner’s conclusion

So what really happens? Either miners are desperate front -moving hardware costs, or more likely they signalize one of the strongest collective voices with confidence in the future of Bitcoin we’ve seen in recent memory. We continue to track these measurements in future updates to see if this miner oversight has been proven right.

If you are interested in more in-depth analysis and real-time data, you may want to consider checking Bitcoin Magazine Pro for valuable insight into the Bitcoin market.

Disclaimer: This article is for information purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.