The introduction of BitVM Smart Contracts has marked a significant milestone in the path of scalability and programmability of Bitcoin. Bitlayer’s finality bridge, which is rooted in the original BitVM protocol, introduces the first version of Protocol Live on the test network, which is a good starting point for realizing the promises of Bitcoin Renaissance or “Season 2”.

Unlike previous BTC bridges, which often demanded dependence on centralized units or questionable assumptions, the finality bridge utilizes a mixture of BitVM-smart contracts, fraud evidence and zero-knowledge evidence. This combination not only improves security, but also significantly reduces the need for trust in third parties. We are not at the trustless level that Lightning delivers, but this is a million times better than current sidekains -Design that claims to be Bitcoin Layers 2S (in addition to significantly increasing the design area for Bitcoin applications).

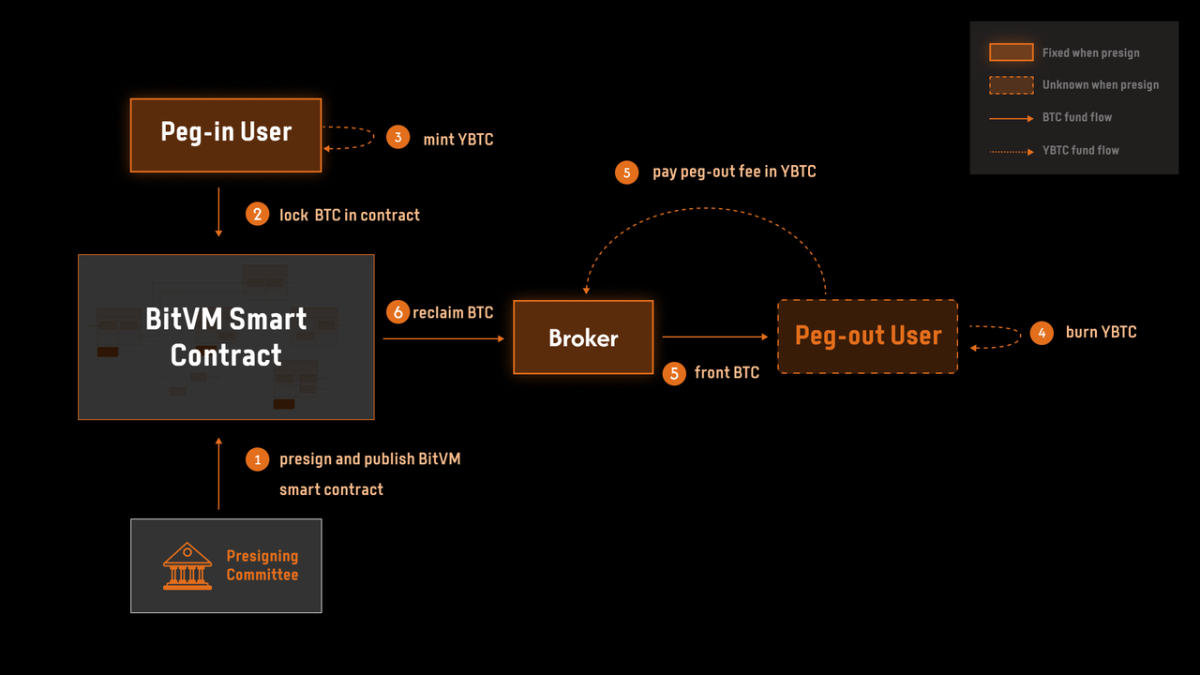

The system operates according to a principle where funds are certainly locked in addresses guided by a BitVM Smart contract that works on the condition that at least one participant in the system will act honestly. This setup reduces inherent confidence requirements, but must introduce additional complexities that Bitlayer aims to control with this version of the bridge.

Mechanics of trust

Practically, when Bitcoin is locked in the BitVM Smart contract through the Finality Bridge, users are issued YBTC -a token that maintains a string 1: 1 -stick with Bitcoin. This point is not only a promise, but is enforced by the underlying smart contract logic, which ensures that each YBTC represents a real, locked bitcoin on the head chain (no false “re -elevated” BTC measurements). This mechanism allows users to participate in defi activities such as lending, borrowing and providing agriculture within the bitlayer ecosystem without compromising the security and settlement insurance insurance that Bitcoin provides.

While some in the community may find these activities that are happening (although covenants would make this bridge design completely “confidently minimized, which would effectively make it a” true “Bitcoin layer 2). For more details about the different levels of risks associated with Sidekain’s design, look at Bitcoin Layer’s assessment of Bitlayer here.

Until such progress comes to execution, however, the Bitlayer finality bridge acts as the best realization of BitVM 2 paradigm. It is a testimony to what is possible after DEV “brain drain” from centralized chains back to Bitcoin. Despite all the challenges that BitVM chains face, I remain unusually excited about the prospect of Bitcoin fulfilling his fate as the ultimate settlement chain for all financial activity.

This article is one Take. Opinions expressed are completely the author’s and does not necessarily reflect BTC Inc or Bitcoin magazine.

Especially Guillaume’s articles can discuss topics or companies that are part of his company’s investment portfolio (UTXO management). The expressed views are solely his own and do not represent the statements of his employer or its affiliated companies. He receives no financial compensation for these taking. Readers should not consider this content as financial advice or endorsement of a particular business or investment. Always make your own research before making financial decisions.