Metaplanet Inc. Widely recognized as Japan’s leading Bitcoin Treasury Company, has reported its strongest quarter to date for Q1 FY2025, characterized by record operation and a significant expansion of its balance.

Revenue reached DKK 877 million. ¥, an increase of 8% increased quarter over quarter (QOQ), while operating profit hit a record 593 million, up 11% QOQ. This marks the company’s highest operating profit ever. Total assets rose to $ 55.0 billion, an increase of 81%, and net assets rose to $ 50.4 billion, an increase of 197% compared to the previous quarter.

Despite a ¥ 7.4 billion valuation loss due to the lower Bitcoin price in late March, the metaplanet rebound has strong. From May 12, the company has $ 13.5 billion in unrealized gains thanks to a recovery in Bitcoin’s market value. The temporary dip affected the net income, which came at DKK 5.0 billion. Dollars in the quarter but core operations remained strong.

The company’s Bitcoin stocks are skyrocketed at 6,796 BTC-an increase of 3.9x year to date. In 2025 alone, the Metaplan added over 5,000 BTC to its treasury, strengthening its commitment to the Bitcoin Treasury standard. Since the adoption of this strategy, the company has seen its BTC Network ADVERRANCE 103.1X and its market capital are growing by 138.1X.

“Guided by this conviction we turned in 2024 to become Japan’s first dedicated Bitcoin Treasury Company,” said the Metaplan’s leadership in their Q1 2025 earnings presentation. “In the 1st quarter of 2025 launched VI-and has already performed 87% of a two-year-old, 116 billion” Moving-Strike “Warrant program: The largest and lowest cost financing of its kind ever placed in Japan.”

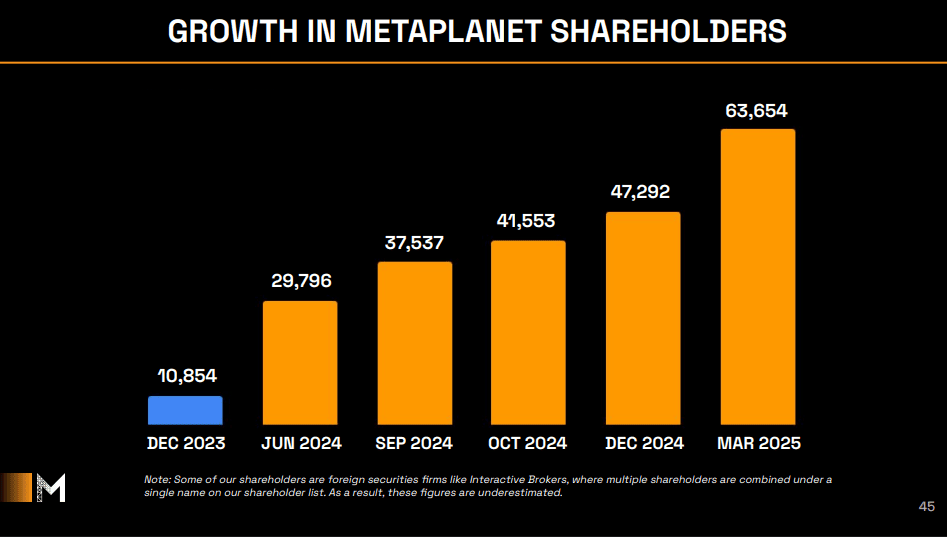

Metaplanet also reported a significant increase in shareholders who grew from 10,854 in December 2023 to 63,654 in March 2025.

Member of Metaplan’s Board of Directors Tyler Evans posted on X, “Congratulations $ MTPLF, Metaplanet, Simon Gerovich, Yoshimi Abe and Dylan Leclair at a record quarter! 3.9x growth in BTC YTD is incredible.”

“Our results speak for themselves: We do not set goals to feel safe – we set them to exceed them, quarter after a quarter,” said the Metaplan’s leadership. “The global feedback -loop between capital markets and Bitcoin has just begun. Metaplanet intends to be its leading wire.”

For those who are interested in reading the full metaplanet -earning report, you can do this.

Disclaimer: Tyler Evans is co -founder and chief investment manager for Utxo, which is also owned and operated by BTC Inc, Bitcoin Magazine’s parent company.